Climate Change

Policy

The Paris Agreement, which aims to keep the increase in global average temperature well below 2°C compared to pre-industrial levels and to strive to limit the increase to 1.5°C, entered the implementation phase in 2020. Expectations toward achieving this goal are growing not only for nations and governments, but also for companies, and it has become necessary for companies to act on climate change through their business activities.

The Toyota Tsusho Group has identified the effort to "Contribute to the transition to a decarbonized society by reducing CO2 emissions from automobiles and factories/plants through the use of clean energy and innovative technologies" as one of its Materiality and has positioned its renewable energy strategy as one of the seven priority domains in its growth strategy.

Another essential climate change countermeasure is the shift to a circular economy. The Toyota Tsusho Group also recognizes the effort to "contribute to the development of a recycling-based society by transforming waste into resources for manufacturing" as one of its materiality. In addition, the "Circular Economy Business" is included under Social Value, one of the value domains defined in the Group's Mid-Term Business Plan.

Our Environmental Policy states that the Toyota Tsusho Group contributes to the transition to a decarbonized society by utilizing clean energy, such as renewable energy, and innovative technologies to reduce greenhouse gas emissions from vehicles, factories, and plants. We aim to achieve a carbon-neutral society in line with the Paris Agreement by promoting emission reductions not only in our own business activities but also across the entire supply chain.

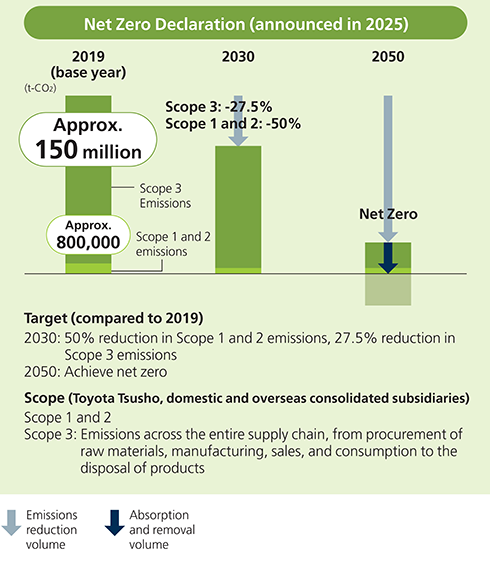

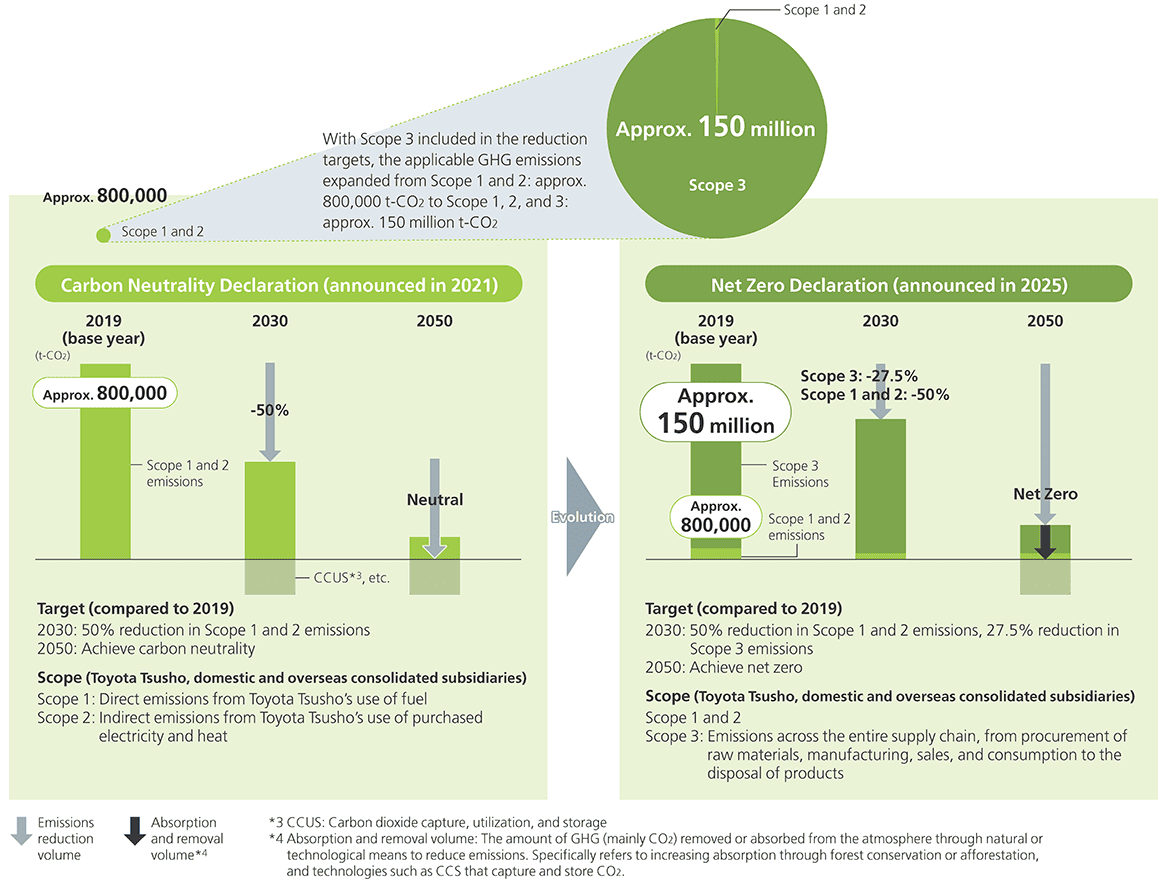

The Toyota Tsusho Group supports the Paris Agreement and, in July 2021, formulated reduction targets for its own emissions (Scope 1 and 2) as a concrete policy toward contributing to the transition to a decarbonized society. In August 2025, we updated these targets and newly established reduction targets for supply chain emissions (Scope 3). Under these targets, we aim to reduce Scope 1 and 2 emissions by 50% and Scope 3 emissions by 27.5% by 2030 compared with 2019 levels, and to achieve net zero greenhouse gas emissions across the entire value chain, including our own operations and supply chain (Scope 1, 2, and 3), by 2050.

Based on the above policy, Toyota Tsusho is promoting carbon neutrality (CN) and a circular economy (CE) worldwide through company-wide climate change countermeasures that incorporate various aspects unique to Toyota Tsusho for the mitigation of the impacts of climate change as well as the minimization-or in other words, the adaptation-of ongoing and potential future damages.

Our group has long been developing businesses that lead to the realization of carbon neutrality and the circular economy. We will continue to further expand businesses that contribute to the transition to a decarbonized society, such as the end-of-life vehicle (ELV) recycling business that we started in the 1970s and the renewable energy business that we have been focusing on since the 1980s.

The Toyota Tsusho Group's strength is its ability to accelerate and promote businesses that contribute to the reduction of greenhouse gases (GHG) throughout the industrial life cycle on a company-wide level. All our employees will work together to contribute to the solution of these social issues by playing a leading role in realizing a carbon neutral and circular economy society.

| Reduction Targets (Compared with 2019 levels) |

Scope: Toyota Tsusho, domestic and overseas consolidated subsidiaries (Scope 1*1, Scope 2*2, Scope 3*3) |

|---|

- *1Direct greenhouse gas emissions from Toyota Tsusho's use of fuel (coal, gas, etc.)

- *2Indirect greenhouse gas emissions from Toyota Tsusho's use of purchased electric power and heat

- *3Indirect GHG emissions across the entire supply chain, from procurement of raw materials, manufacturing, sales, and consumption to disposal.

- *4The amount of GHG (mainly CO2) removed or absorbed from the atmosphere through natural or technological means to reduce emissions. Specifically, this refers to increasing absorption through forest conservation and afforestation, and technologies such as CCS (Carbon Capture and Storage) that capture and store CO2.

Carbon Neutrality Promotion Meeting

The Toyota Tsusho Group holds the Carbon Neutrality Promotion meeting, chaired by the president & CEO, once a month to determine the strategies to achieve carbon neutrality for the group and the world.

The Carbon Neutrality Promotion meeting confirms the connection between the group's greenhouse gas emissions reduction measures and the policies and proposals of countries around the world toward the realization of carbon neutrality, and discusses and decides on growth strategies through five working groups.

| Chairperson | President & CEO | |

|---|---|---|

| Secretariat | Representative officer in charge | CTO*1 |

| Department | Carbon Neutrality Promotion Department | |

| Meeting Members | Executive vice president CSO*1 CFO*1 CHRO*1 CEO of each region*1 Representative Officer in charge of carbon neutrality at each Sales Division Leader of 5 working group (appointed by executive officers) Deputy CSO (responsible for Corporate Planning Department) Deputy CSO (responsible for External Affairs Department) CSKO*1 (responsible for Global Safety & Environmental Promotion Department) |

|

- *1 CTO: Chief Technology Officer

CSO: Chief Strategy Officer

CFO: Chief Financial Officer

CHRO: Chief Human Resources Officer

CEO: Chief Executive Officer

COO: Chief Operating Officer

CSKO: Chief Safety & KAIZEN Officer

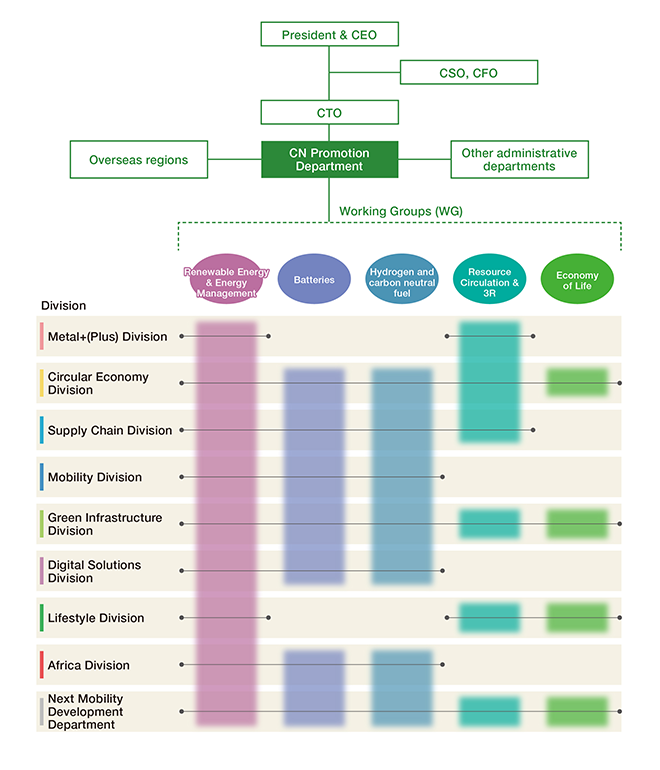

Carbon Neutrality Promotion Structure

Our group established the Carbon Neutrality Promotion Department with the mission of promoting carbon neutrality throughout the company to further accelerate our initiatives toward decarbonization both within and outside the group. In addition to designing systems and managing emissions to achieve the Toyota Tsusho Group Carbon Neutrality Declaration, five working groups have been established under the initiative of the Carbon Neutrality Promotion Department. These working groups were organized based on the growth strategies of business areas linked to carbon neutrality and the circular economy, in which our group has strengths, to achieve both business expansion and a decarbonized society along both vertical and horizontal axes. We have formulated the Carbon Neutrality Roadmap 2030 for these five working groups and are monitoring their progress.

Mission: Passing on a better global to the children of the future

Vision: The world's leading circular economy provider

- *1Carbon Neutrality

- *2Green Management

- *3Next Mobility Development Department

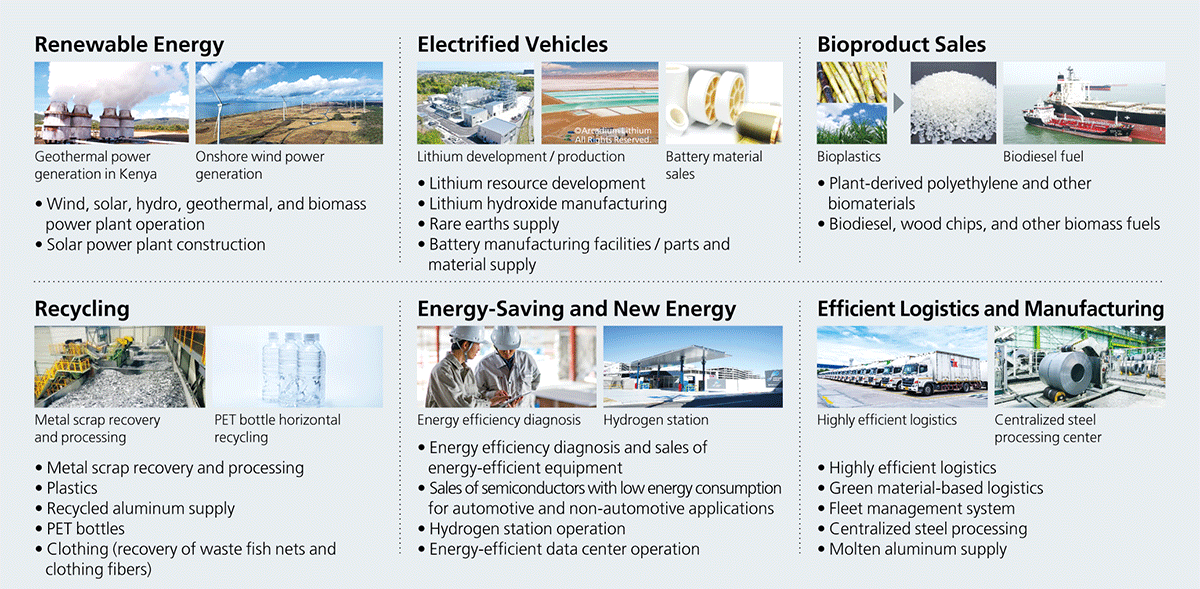

Five Working Groups to Promote Carbon Neutrality

We have formed working groups (WG) in five areas in which we are particularly strong to aggressively promote these initiatives that will lead to carbon neutrality.

We are engaged in businesses that support a circular economy at each stage of the industrial life cycle, which consists of energy creation, energy collection and coordination, manufacture of goods, transport of goods, use of goods, waste processing, and reuse and recycling.

Disclosure Based on TCFD Recommendations

The Toyota Tsusho Group recognizes that climate change is a key management issue and, in May 2019, endorsed the Taskforce on Climate-related Financial Disclosures (TCFD). In line with TCFD recommendations and based on stakeholder dialogue, the group proactively engages in information disclosure as a responsible global company.

1. Governance

Our corporate group identified climate change as one of the material issues that matter most to our business. The content of our Materiality initiatives is verified by a meeting of the Sustainability Committee (held annually)*1 , which is chaired by the president & CEO and incorporated into our business strategies via the sales division CEOs who make up the committee. Since 2020, the committee has been tasked with setting key performance indicators (KPIs) for material issues, monitoring their progress, and reporting on the particulars of deliberations to the Board of Directors meeting. Members of the Board have a wealth of experience and competence concerning ESG issues, including climate change, and have put in place a system to ensure that appropriate oversight is carried out.

To address climate change, the Carbon Neutrality Promotion Meeting (held monthly)*2 , which is chaired by the president & CEO, discusses strategies for transitioning to a decarbonized society. The meeting also manages progress in reducing our greenhouse gas (GHG) emissions. The Carbon Neutrality Promotion Department, which was established in April 2022, serves as the secretariat for the committee and is responsible for further accelerating our decarbonization efforts as a specialized organization.

The status of achievement of energy-saving targets, as well as responses to climate change-related revisions to laws and regulations and new requirements, are deliberated at our annual Safety and Environment Conference*3. Our progress is also confirmed at the conference. The representatives of the sales divisions and group companies who make up the members of the conference incorporate the details of these deliberations into our business activities.

We have introduced an internal carbon pricing system to promote reductions in GHG emissions. Under this system, the progress of each sales division's efforts to reduce GHG emissions is reflected in the performance and compensation of the CEO responsible for that division.

*1

| Sustainability Management Committee | Decisions on policies and important issues related to Materialities, including climate change |

|---|---|

| Chairperson | Toshimitsu Imai (President & CEO) |

| Representative officer in charge | Hiroshi Tominaga (CSO*4) |

| Secretariat | Sustainability Management Group, Corporate Planning Department |

*2

| Carbon Neutrality Promotion Meeting | Decisions on strategies toward the achievement of carbon neutrality |

|---|---|

| Chairperson | Toshimitsu Imai (President & CEO) |

| Representative officer in charge | Jun Karato (CTO*5) |

| Secretariat | Carbon Neutrality Promotion Department |

*3

| Safety and Environment Conference | Progress management of responses to climate change-related laws and regulations, etc. |

|---|---|

| Chairperson | Tatsuya Watanuki (Exective Vice President) |

| Representative officer in charge | Hideyuki Matsumura (CSKO*6) |

| Secretariat | Global Safety & Environmental Promotion Department |

- *4CSO : Chief Strategy Officer

- *5CTO : Chief Technology Officer

- *6CSKO : Chief Safety & KAIZEN Officer

2. Strategy

(1) Climate-related Risks and Opportunities

| Category | Anticipated Impact | Impact Timeline*3 |

||

|---|---|---|---|---|

| Risks | Transition*1 | Policy and Regulation | Increase in business costs due to introduction of carbon tax, etc. | Medium-term~ Long-term |

| Technology | Change in demand for existing products/services due to introduction of low carbon/decarbonization technologies | Medium-term~ Long-term |

||

| Markets | Changes in demand for existing products/services due to changes in market conditions | Medium-term~ Long-term |

||

| Reputation | Reputation damage due to delays in climate change action or poor disclosure | Medium-term~ Long-term |

||

| Physical*2 | Acute | Business damage due to more frequent and increasingly severe wind and flood damage | Short-term~ Long-term |

|

| Chronic | Impact on business due to rising temperatures and sea levels | Long-term | ||

| Opportunities | Resource Efficiency | Increased demand for our recycling business due to growing awareness of resource recycling | Short-term~ Long-term |

|

| Energy Sources | Growing demand for our renewable energy business due to increasing need for renewable energy | Short-term~ Long-term |

||

| Products and Services | Growing demand for products and services that contribute to decarbonization and reducing carbon | Short-term~ Long-term |

||

| Markets | Growing business opportunities in emerging markets as they grow and mature | Short-term~ Long-term |

||

- *1Transition risks: Risks posed by changes in policy and regulation, technology, market environment, etc., associated with the transition to carbon neutrality

- *2Physical risks: Risks posed by increasingly severe natural disasters and changes in temperature and precipitation

- *3Short-term: less than 1 year, medium-term, up to 3 years, long-term: 4 or more years

In response to the risks and opportunities described, we are actively working to not only reduce Scope 1 and Scope 2 emissions but also to reduce Scope 3 emissions and contribute to the greenhouse gas emissions reduction efforts of society.

(2) Scenario Analysis

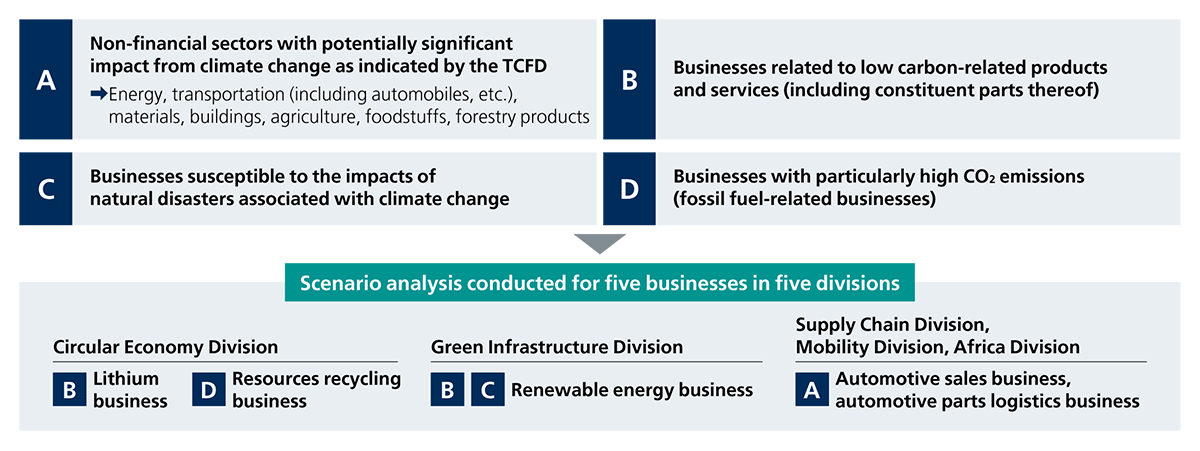

We conduct scenario analysis, following the TCFD recommendations, of selected businesses that are significantly impacted by climate change.

As for the impact on business, we selected factors that are significantly affected, and conducted a scenario analysis. In terms of risks, we considered transition risks (policy and regulation, technology, markets, and reputation) and physical risks (acute and chronic) while taking into account resource efficiency, energy sources, products and services, and markets in terms of opportunities.

Furthermore, we aim to reduce our greenhouse gas emissions by 50% compared to the 2019 level by 2030, and we used the year 2030 as the time frame for this scenario analysis as well.

Reference Scenarios

We referred to the following scenarios from the International Energy Agency (IEA), Intergovernmental Panel on Climate Change (IPCC), and other sources to assess new business opportunities and business resilience and to analyze the impact on our business in the event of significant changes in our business environment as a result of climate change.

| Category | Scenario overview | Main reference scenarios |

|---|---|---|

| Below 1.5°C/2°C scenario |

Under this scenario, policies and regulations are implemented to achieve a decarbonized society and the global temperature increase from the pre-industrial level remains below 1.5°C/2°C. Although the transition risk is higher than under the 4°C scenario, the physical risk is lower. |

|

| 4°C scenario | Under this scenario, no new policies or regulations are introduced and greenhouse gas emissions continue to increase. The transition risk is lower than under the below 1.5°C/2°C scenario, but the physical risk is higher. |

|

Selection of Subject Businesses

Selecting businesses with large climate change impacts (from perspectives A to D below) among all our group's businesses, we performed scenario analyses with the lithium, resource recycling, renewable energy, automotive sales, and automotive parts logistics businesses. The molten aluminum business, selected until the fiscal year ended March 31, 2024, is included in the resource recycling business from the fiscal year ending March 31,2025 from the perspective of expanding the scope of GHG emissions and scenario analyses. For the same purpose, we added the automotive parts logistics business into the scope of scenario analysis.

The scenarios and understanding of the business environment in this scenario analysis are based on major scenarios presented by international organizations and others and do not represent the medium- to long-term outlook.

(3) Results of Scenario Analysis for Each Business

Toyota Tsusho's production of lithium carbonate began in 2014 at Salar de Olaroz, Argentina, to supply raw materials used in automotive lithium-ion batteries (LiBs), which are essential for electrified vehicles. We constructed a lithium hydroxide manufacturing plant in Naraha-machi, Fukushima Prefecture, and production started in 2022.

Climate-related Risks and Opportunities

| Category | Details |

|---|---|

| Risks | Reduction in volume of lithium carbonate production in Argentina caused by natural disasters, extreme weather conditions, etc. |

| Opportunities | Increase in demand for lithium products due to vehicle electrification, etc. |

Impact on Businesses in Each Scenario

| Below 1.5°C/2°C scenario |

In a comparison between the below 1.5°C/2°C scenario and the 4°C scenario, a larger increase in demand for electrified vehicles and storage batteries is expected in the below 1.5°C/2°C scenario, resulting in greater opportunities for this business overall. |  |

|---|---|---|

| 4°C scenario | Regarding the risk of reduced lithium production efficiency at the lithium carbonate production site in Argentina due to changes in rainfall, any impact on lithium production is expected to be minor as the level of precipitation is expected to remain relatively constant, judging from the results for 2022 and the years leading up to it. |  |

In both scenarios, demand for electrified vehicles and storage facilities that use lithium batteries is expected to increase.

Our Measures

We will aim to build a long-term stable supply structure by enhancing our existing capacity to meet the increasing demand for lithium that will accompany the full-scale popularization of electrified vehicles. In addition, we will expand our business domain and build a structure for the stable supply of lithium hydroxide in preparation for the expected increase in demand due to increasing battery capacity in the future.

Our group has a long history of recycling. Since the 1970s, we have been promoting a circular economy as one of our businesses for roughly 50 years. Based on the recognition that all goods are resources, we recover, sort, and recycle them to promote resource recycling in support of manufacturing.

Climate-related Risks and Opportunities

| Category | Details |

|---|---|

| Risks | Difficulty in securing sufficient volume resulting from decreasing waste Resource price fluctuations |

| Opportunities | Market expansion in line with an increase in demand for recycled materials |

Impact on Businesses in Each Scenario

| 1.5°C scenario | Under the 1.5°C scenario, opportunities for the business as a whole are estimated to expand as the market expands due to an increased demand for recycled materials. |  |

|---|---|---|

| 4°C scenario | Under the 4°C scenario, the market will not expand at the scale estimated to occur under the 1.5°C scenario. The impact on the business as a whole is thus estimated to be limited. |  |

Our Measures

This business is positioned as our main circular economy business, which is one of our priority domains, and we will reinforce the recycling value chain from upstream to downstream to establish a closed-loop system.

We are expanding wind, solar, hydroelectric, geothermal, biomass, and other power generation businesses globally. As well, we are focusing on promoting development in Africa and emerging countries and the development of offshore wind power generation.

Climate-related Risks and Opportunities

| Category | Details |

|---|---|

| Risks | Impact on business due to revision of renewable energy-related policies (feed-in tariffs, subsidies, tax breaks, etc.) |

| Opportunities | Increase in demand for renewable energy |

Impact on Businesses in Each Scenario

| Below 1.5°C/2°C scenario |

In the below 1.5°C/2°C scenario, although the discontinuation of feed-in tariffs as a result of the revision of renewable energy policies could have an impact, it is expected that worldwide development of policies and a significant increase in demand for renewable energy will lead to progress of related technological innovations and renewable energy becoming a core energy source. Accordingly, the opportunities for this business as a whole are expected to expand as development progresses in response to the demand for renewable energy. |  |

|---|---|---|

| 4°C scenario | In the 4°C scenario, demand for renewable energy is expected to increase to a certain level, although not to the same degree as under the below 1.5°C/2°C scenario. While there is a possibility that the business could be affected by policy revisions, the impact on the business as a whole is limited. |  |

Our Measures

As this business is positioned as one of our priority domains, we plan to expand our business, including diversifying our portfolio of power sources and conducting energy management, while accelerating global development by reinforcing our existing businesses. We will contribute to the creation of a better global environment through the stable supply of renewable energy with a competitive advantage.

We export passenger cars, commercial vehicles including trucks and buses, industrial vehicles, and spare parts produced by automobile and transport equipment manufacturing makers, primarily in the Toyota Group in Japan and overseas, to countries around the world. As well, we conduct business as sole import distributors and dealers through our global network that spans 150 countries around the world.

Climate-related Risks and Opportunities

| Category | Details |

|---|---|

| Risks | Impact on business due to changes in the sales mix of gasoline and electrified vehicles |

| Opportunities | Increase in demand for electrified vehicles |

Impact on Businesses in Each Scenario

| Below 1.5°C/2°C scenario |

In the below 1.5°C/2°C scenario, the share of gasoline vehicles in total sales volume is expected to decrease due to stricter fuel efficiency regulations, though the share of electrified vehicles is expected to increase, expanding opportunities for this business as a whole. |  |

|---|---|---|

| 4°C scenario | In the 4°C scenario, fuel efficiency regulations will not be tightened to the same degree as under the below 1.5°C/2°C scenario, and the impact on the sales ratio of gasoline and electrified vehicles will be small, so the impact on the overall business is expected to be limited. |  |

In both scenarios, the total sales volume of new vehicles is expected to increase globally, especially in emerging countries, thus the risk to the overall business is expected to be minor.

Our Measures

Given that the new vehicle market is expected to continue to expand, especially in emerging countries, we will strengthen our sales structures worldwide. We will also promote the popularization of electrified vehicles by securing resources for battery materials, which are key components of electrified vehicles, and by expanding the vehicle battery 3R (Rebuild, Reuse, Recycle) business domain along with expanding our lineup of electrified vehicles.

Our group operates affiliates and business frameworks around the world. Utilizing each site and logistic network, we have established a seamless, optimal parts logistics structure and a global-scale automotive parts supply chain.

From the fiscal year ending March 31, 2025, we newly started the analysis of the automotive parts logistics business to expand the scope of our GHG emissions and scenario analyses.

Climate-related Risks and Opportunities

| Category | Details |

|---|---|

| Risks | Impact to be brought about by changes in automotive components as automotive electrification progresses |

| Opportunities | Increase in demand for expensive automotive parts manufactured with new technologies as automotive electrification progresses |

Impact on Businesses in Each Scenario

| 1.5°C scenario | Under the 1.5°C scenario, increases in the handling volume of parts and products, such as expensive batteries, are expected with changing automotive components as electrification progresses. Opportunities for this business are estimated to expand with the continuously increasing volume of automotive production worldwide. |  |

|---|---|---|

| 4°C scenario | Under the 4°C scenario, it is projected that the progress of electrification would be slow compared to that under the 1.5°C scenario. The impact on the business as a whole would thus be limited, and opportunities for the business are estimated to be stable or expand with the continuously increasing volume of automotive production worldwide. |  |

Our Measures

As the volume of automotive production worldwide increases, the automotive parts market is estimated to expand going forward. Our group will contribute to the sustained growth of the automotive parts supply chain by reinforcing relationships with new parts partners for electrification and promoting green logistics.

3. Risk Management

We manage environmental risks and opportunities, including climate change, to a high standard. Businesses and risks/opportunities related to climate change are deliberated by the Carbon Neutrality Promotion Meeting, the Safety and Environment Conference, and the Sustainability Management Committee, and their members incorporate the details of these deliberations into our business strategies and activities. In particular, the Carbon Neutrality Promotion Meeting, chaired by the president & CEO, meets monthly to identify climate change risks and opportunities in light of the external environment and assess their impact on us, as well as to verify the progress of climate change-related businesses.

The Integrated Risk Management Committee defines the 10 most important risk items, including the environment, to focus on to review our global risk management status. The committee also manages climate change risk in the company-wide risk management process.

We have acquired certification under ISO 14001, an international standard related to environmental management systems, to monitor our risk management processes. Toyota Tsusho conducts internal environmental audits of domestic and overseas consolidated subsidiaries once every three years.

Investments and Loans

Toyota Tsusho's officers participate in various meetings to confirm the impacts that our investment activities have on ESG: The executive vice presidents, CSO, and CFO*1 take part in the Investment and Loan Committee; the deputy CSO and deputy CFO in the Investment and Loan Meeting; and the president & CEO, executive vice presidents, CSO, CFO, and general manager of the Corporate Planning Department in the Investment Strategy Meeting. Projects that meet or exceed certain requirements and are approved by the Investment and Loan Committee or the Investment and Loan Meeting are required to undergo a preliminary carbon neutrality assessment. This assessment determines the Scope 1 and Scope 2 emissions that will increase as a result of the investment, how they can be reduced, and how the investment will contribute to Scope 3 reductions as well as to GHG emissions reductions in society.

- *1CFO: Chief Financial Officer

4. Metrics and Targets

GHG Emissions Reduction Targets and Future Initiatives

The carbon neutrality of our GHG emissions, as well as our contribution to a decarbonized society, is essential. Therefore, in support of the Paris Agreement and as a concrete policy toward contributing to the transition into a decarbonized society, we established a target of reducing GHG emissions (Scope 1 and Scope 2) by 50% compared to 2019 levels by 2030 and achieving carbon neutrality by 2050.

We are promoting comprehensive energy conservation and renewable energy measures (installing LED lighting and solar power generation facilities, etc.). We also aim to achieve this goal by reducing greenhouse gas emissions from production processes and logistics operations through fuel conversion, efficient consumption, and technological innovation.

In order to further strengthen our initiatives aimed at reducing greenhouse gas (GHG) emissions, beginning in fiscal year 2025, we have incorporated the degree of contribution to CN initiatives into the performance evaluation criteria for line managers. This measure is intended to enhance awareness of carbon neutrality among managerial staff and to foster the implementation of concrete actions at the operational level.

The capability to accelerate and promote businesses that contribute to the reduction of greenhouse gases (GHG) throughout the entire industrial life cycle is one of our strengths. All of our employees will unite and exert themselves to contribute to the solution of these social issues.

| Reduction Targets |

Included: Toyota Tsusho, domestic and overseas consolidated subsidiaries (Scope 1 and Scope 2) Note: Scope 3 promotes specific initiatives with suppliers and customers to reduce GHG emissions throughout the value chain. |

|---|

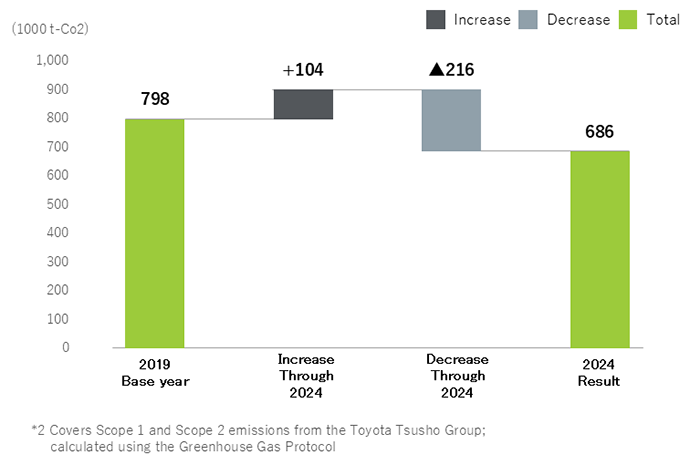

Scope 1 and Scope 2 Emissions Reduction

Comparing the results of 2023 to the base year (2019), emissions increased in line with our business expansion, including the establishment of a PET bottle recycling plant and a lithium plant that can also be used for supply to electrified vehicles.Nevertheless, we attained a reduction of 62,000 t-CO2, which exceeded the volume of the increase.

- *2Covers Scope 1 and Scope 2 emissions from the Toyota Tsusho Group; calculated using the Greenhouse Gas Protocol

- *3Carbon dioxide capture, utilization, and storage

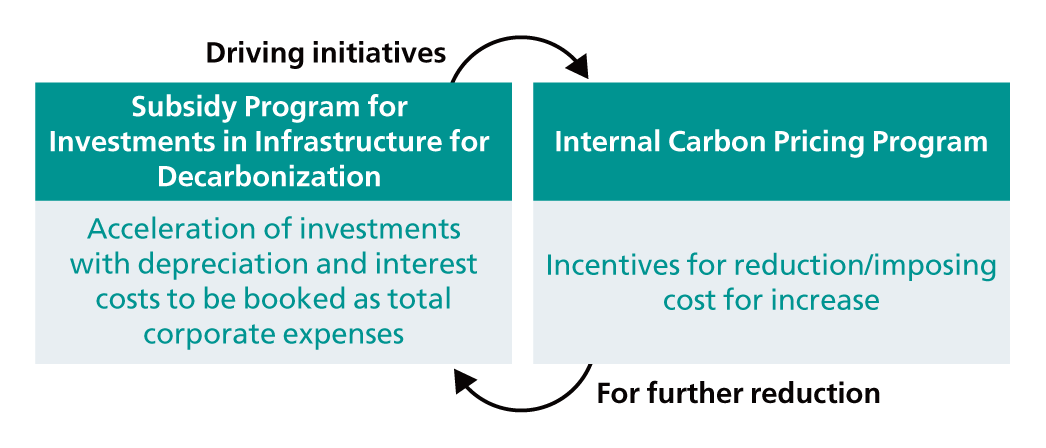

Subsidy Program for Investments in Infrastructurefor Decarbonization / Internal Carbon Pricing Program

We have introduced a mechanism for subsiding burdens such as depreciation and interest payable related to GHG emissions reduction investments as company-wide expenses (Subsidy Program for Investments in Infrastructure for Decarbonization) as well as that for adjusting divisional performance appraisal according to the level of increase/decrease in GHG emissions by each division (Internal Carbon Pricing Program / unit price: ¥30,000/t-CO2) to create a virtuous cycle for encouraging GHG emissions reduction initiatives.

Green Bond

Our company has formulated the "Green Finance Framework" to issue green bonds and procure green loans.This framework is based on the Green Bond Principles 2021 as administered by the International Capital Market Association (ICMA) and the Green Loan Principles 2021 by the Loan Market Association (LMA), the Asia Pacific Loan Market Association (APLMA), and the Loan Syndications and Trading Association (LSTA).

Initiatives for Reducing Greenhouse Gas Emissions

Growth Strategy as a Trading Company Striving Toward Decarbonization

New Emissions Reduction Target Set for the Entire Value Chain Including Scope 3

In 2021, the Toyota Tsusho Group established the "Carbon Neutrality Declaration," committing to achieve carbon neutrality by 2050 for its own emissions-Scope 1 and 2. To fulfill our Mission of "passing on a better Earth to the children of the future," we have now evolved this into the "Net Zero Declaration," which includes Scope 3 emissions-those generated throughout the entire value chain.

Aiming to become a trading company driving decarbonization, we will not only reduce our own emissions, but also work in collaboration with stakeholders to reduce emissions across the entire value chain.

Initiatives for Reducing GHG Emissions

Our corporate group reduces Scope 1, 2, and 3 emissions through Toyota Tsusho's distinctive initiatives, and we provide approaches to those such to our customers to contribute to society's efforts to achieve avoided emissions and to create new business opportunities.

- *The Toyota Tsusho Group is proactively installing solar panels at its sites in Japan and overseas for in-house use.

Representative examples include the Toyota Branch Office as our owned building in Japan and Tianjin Toyota Tsusho Steel Co., Ltd. (TJTS) in China, both of which have achieved CO2 reductions through the use of renewable energy.

Looking ahead, the Group plans to further expand the installation of renewable energy facilities at its domestic and overseas sites and is also systematically advancing the purchase of electricity derived from renewable energy sources.

Scope 3 Emissions Results for 2024

For 2024, our corporate group recorded approximately 113million t-CO2 of Scope 3 emissions in total. Characteristics of emissions from our business activities are as follows.

- We handle low volumes of metal resources and fossil fuels,which are significant GHG emitters, and the number of our businesses that emit a large volume of CO2, such as thermal power generation, is limited.*4

- We have been engaging in a variety of initiatives centering on the automotive supply chain. Emissions classified as those arising from Purchased Goods and Services (Category 1) and Use o+C30f Sold Products (Category 11) account for the majority.

We will implement the major initiatives described on Scope 3 Emissions Reduction Initiatives throughout the automotive supply chain to reduce Category 1 and Category 11 emissions, which are high

- *4Planning to withdraw completely from coal-and heavy oil-fired power generation businesses after the fiscal year ending March 31, 2025, and from thermal power generation projects at an early phase

| Category | Emission (1,000 t-CO2) |

|---|---|

| 1 Purchased goods and services | 72,282 |

| 2 Capital goods | 593 |

| 3 Fuel-and energy-related activities (not included in Scope 1 or Scope 2) |

122 |

| 4 Upstream transportation and distribution | 3,689 |

| 5 Waste generated in operations | 20 |

| 6 Business travel | 9 |

| 7 Employee commuting | 31 |

| 8 Upstream leased assets | 0 |

| 9 Downstream transportation and distribution | 4,986 |

| 10 Processing of sold products | 143 |

| 11 Use of sold products | 28,215 |

| 12 End-of-life treatment of sold products | 17 |

| 13 Downstream leased assets | 26 |

| 14 Franchises | 6 |

| 15 Investments | 3,088 |

| Total | 113,226 |

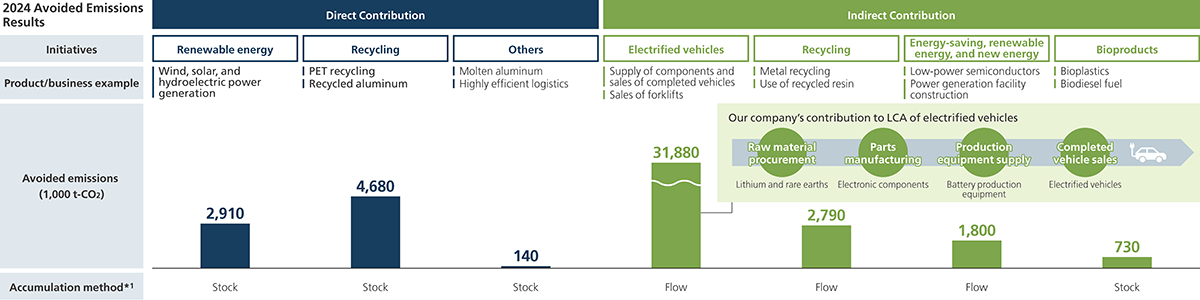

Turning Value Chain-Wide Emissions Reductions and Avoided Emissions into Business Opportunities

The Toyota Tsusho Group views GHG emissions reduction as a business opportunity and offers various "Toyota Tsusho-uniqueness" initiatives to customers.

Going forward, we will continue to expand our business by contributing to emissions reduction across the entire value chain and in society, with a focus on the five working groups specializing in CN and CE-areas of strength for the group.

To track business expansion, we quantify various reduction activities and disclose them under two categories: "direct contribution*2," referring to reductions from products and services manufactured or provided by the company; and "indirect contribution*2," referring to reductions the group indirectly contributes to through products of other companies. (2024 results: direct contribution of approx. 8 million t-CO2, indirect contribution of approx. 37 million t-CO2)

- *2

Direct Contribution /Indirect ContributionDirect contribution:Emissions avoided by our final products and services that have an emissions reduction effect or those avoided through our manufacturing processes

(Others: Although we have yet to calculate the volume of avoided emissions, we are taking the lead in multiple initiatives that contribute to society's GHG emissions reduction, such as nonferrous metal scrap recovery and processing and energy-efficient data center operation.)Indirect contribution:Emissions avoided by our company's conducting a part of the manufacturing processes of final products and services that have an emissions reduction effect or by our sales of final products and services that have an emissions reduction effect

Calculation method: We refer to guidelines published by METI, the Institute of Life Cycle Assessment, Japan, and the World Business Council for Sustainable Development (WBCSD), among others, in calculating avoided emissions. As there are no universal rules for calculating avoided emissions at present, we will appropriately review our calculation methods and information to disclose based on international discussions and trends in society.

(Emissions from existing products, services, and manufacturing processes-emissions from new products, services, and manufacturing processes) x volume of diffusion

- *3For accumulation methods, refer to Section 5.5 "Avoided Emissions Accumulation Methods" of the Guideline for Avoided GHG Emissions Quantification issued by Japan's Ministry of Economy, Trade and Industry (METI).

Calculation example

Recycled aluminum: Avoided emissions are calculated based on the difference between emissions from the use of recycled aluminum and the use of virgin metal, both being supplied by our company.

Electric vehicles: (Internal combustion engine vehicle LCA*5 emissions*4-electric vehicle LCA emissions*4) x number of electric vehicles sold for which our company is involved in a part of their supply chain

- *4Internal combustion engine vehicle and electric vehicle LCA emissions were calculated while referring to the IEA's Global EV Outlook 2024

- *5LCA: Life cycle assessment; a method to quantitatively assess the environmental burden of a product throughout its life cycle

Compliance with Laws and Regulations

Toyota Tsusho endorses the Paris Agreement and fully supports laws, regulations, and policies that help mitigate climate change, such as the Act on Rationalizing Energy Use and the Act on Promotion of Global Warming Countermeasures. We submit an annual report to the government on energy consumption, progress toward energy conservation targets, and greenhouse gas emissions.

Under the business classification evaluation system in the Act on Rationalizing Energy Use, we received an "S class" rating which indicates that we are a business with excellent energy conservation. Through these efforts, we are playing a role in achieving the greenhouse gas reduction target.

BCPs in Anticipation of Climate Disaster Risks (Adapting to Climate Change)

Toyota Tsusho is formulating measures for adapting to climate change with the objectives of responding to the effects of climate change and preventing or mitigating damage. The risks of weather disasters from events such as torrential rain and extreme heat are rising. The entire Group is taking action with an awareness that the formulation, management, and operation of business continuity plans (BCPs) that anticipate these risks is crucial.

Case Study: Business Continued at an Alternate Site During Flooding in Thailand

Toyota Tsusho formulated BCPs that anticipate the inability to use key management resources as a result of physical risks of climate change and is taking various responsive measures.

In 2011, when the northern and central regions of Thailand experienced widespread flooding, damage occurred in Bangkok and seven industrial parks, and some 450 Japanese-affiliated companies were affected. Two years later, when massive flooding again occurred in October 2013, the Amata Nakhon Industrial Estate, one of Thailand's largest, was flooded and extensive damage again occurred. Despite this, TTK Asia Transport (Thailand) Co., Ltd., a Toyota Tsusho Group transportation company with a site in the industrial park, had a BCP in place, enabling it to relocate all personnel and trucks to an alternate site and maintain operations without interruption.

Investment Strategy

By 2030, Toyota Tsusho will invest 2 trillion yen scale for the achievement of decarbonized society. Toyota Tsusho identified five priority areas that promote the circular economy in each stage of the industrial lifecycle; "energy creation," "energy collection and coordination," "manufacture of goods," "transport of goods," "use of goods," "waste processing," and "reuse and recycling."

Essentially Achieving 100% Renewable Energy Use for Electricity Used at All Offices in Japan

The company has been CO2 free at all 18 offices in 11 prefectures in Japan through the use of non-fossil certificates with tracking for electric power used in the fiscal year 2022, essentially achieving 100% renewable energy use.

Stakeholder Engagement Regarding CN/CE/NP

By actively disclosing initiatives related to CN/CE/NP to both internal and external stakeholders, the Group aims to become known as a trading company driving decarbonization. In order to foster a culture where CN is promoted with a sense of ownership, the Group is enhancing internal communication and also focusing on external communication to strengthen collaboration among partners promoting CN realization. Through these efforts, the Group contributes to society's overall achievement of CN.

Internal Communication

CN/CE global conference

The "CN/CE Global Conference" was held as an initiative to raise awareness and understanding of CN and CE in overseas regions. Active discussions took place on sharing best practices for GHG emissions reduction and considering measures to foster CN momentum within each region. Going forward, we will continue to strengthen collaboration among overseas staff through face-to-face communication.

Carbon Neutrality App

We have developed the Carbon Neutrality App to deepen the understanding of carbon neutrality among all employees and to utilize it as a useful tool for sales activities.

The app provides an environment in which employees can enjoy learning the importance of carbon neutrality through carbon neutrality educational content and a function that facilitates exchanges among employees, etc. Through the app, we will strive to raise employees' carbon neutrality awareness and elevate internal momentum toward the promotion of carbon neutrality.

Internal Award

Starting in the fiscal year ending March 31, 2025, we have added a Carbon Neutrality Award to our Be the Right ONE Awards, which is a program that recognizes organizations and employees who significantly contribute to the company throughout the year. The Carbon Neutrality Award will recognize model initiatives for realizing carbon neutrality, and adding it will further promote carbon neutrality, as winning organizations and business entities are to serve as drivers of carbon neutrality initiatives by other organizations and business entities.

External Collaboration

External Communication

A CN/CE exhibition was held to broadly raise awareness of the Group's CN/CE initiatives among stakeholders in the automotive supply chain. The event was recognized for fostering external exchange among suppliers and received Toyota Motor Corporation's "Environmental Excellence Award" for suppliers.

External Contests

We actively enter various external contests to widely promote recognition of our initiatives.

JARA Co., Ltd., a Group company that operates a sales system for reused auto parts, together with its business network, the JARA Group, received the "Director-General's Award for Promotion of the Transition to a Decarbonized Economic Structure" at the FY2024 Awards for Resource Circulation Technologies and Systems.

Furthermore, North Hokkaido Wind Energy Transmission Corporation, established with investment from Group company Eurus Energy Holdings Corporation and others, received the "Minister of the Environment Award for Climate Action" in FY2024.

Going forward, the Toyota Tsusho Group will continue to contribute to the realization of a sustainable society through CN/CE businesses, with the aim of "passing on a better Earth to the children of the future."

Carbon Neutral Product and Service Catalog

This catalog covers our corporate group's carbon neutrality-related solutions, which are linked to each of Scope 1, Scope 2, and Scope 3. We will contribute to the transition to a decarbonized society by helping our customers reduce greenhouse gas emissions through the various solutions that our group has accumulated over the years.

Strengthening Collaboration with Zeroboard, a Provider of Greenhouse Gas Emissions Calculation and Visualization Services

Our group has been strengthening collaboration with Zeroboard Inc., a company that provides "zeroboard," a service for calculating and visualizing greenhouse gas emissions. In addition to the use of the service at Toyota Tsusho, we will work with Zeroboard to promote the visualization of greenhouse gas emissions and reduction of carbon footprints for customers and suppliers in Japan and overseas, particularly in the automotive industry, and provide greenhouse gas emission reduction solutions such as renewable energy and recycling businesses. By serving as a one-stop provider of these solutions, we will contribute to the realization of carbon neutrality throughout the value chain.

External Collaboration

Implementation of decarbonization policies and recommendations, and collaboration with external organizations

Aspiring toward the early realization of a decarbonized society, we collaborate with external partners that share our sense of urgency to tackle climate change challenges and the energy crisis. To support the achievement of the Paris Agreement's 1.5°C target, we advance various global warming initiatives through collaboration with industry groups and implementation of policies and recommendations.

The Carbon Neutrality Promotion Meeting receives reports on the state of our involvement in external organizations and lobbying, with the President & CEO holding final responsibility for this area. Priority matters are reported to the Board of Directors, which assesses, manages, and appropriately monitors whether those external organization and lobbying activities are aligned with the principles of the Paris Agreement.

Our involvement in industry groups includes expressing opinions grounded in our sustainability concepts as part of those groups' decision-making process for setting new directions in climate change actions. During industry group meetings, we provide recommendations that reflect the thinking of our investors, customers, and the international community.

In cases where industry policies differ from our own, we pursue coordinating efforts aimed at reconciling those policies with our ideals. When necessary, new policies established by industry groups are reported to our relevant departments to garner their approval. Matters that impact our corporate group as a whole are reported to the CSO and coordinated by the Sustainability Committee or the Carbon Neutrality Promotion Meeting. In the event that an industry group adopts policies that strongly conflict with our thinking, we will, if necessary, consider the option of withdrawing from that group.

Japan Business Federation

Committee on Environment

As a member of the Committee on Environment of the Japan Business Federation (Keidanren), we issue recommendations that seek to balance environmental policies with economic sustainability. Our proposals cover areas such as the promotion of green transformation (GX), climate change measures, and circular economy development, the enhancement of environmental regulations and schemes, collaboration with the Keidanren Nature Conservation Council, the Challenge Zero initiative, contribution to emissions reductions across global supply chains, and the pursuit of voluntary initiatives.

Committee on Energy and Resources

We also serve on Keidanren's Committee on Energy and Resources, supporting the promotion of the S+energy policy strategy for balancing energy security, economic efficiency, and environmental protection while maintaining an overarching commitment to safety. We promote the development of better energy policies by actively offering ideas and opinions informed by our perspective as an industry member, and by supporting activities for putting those proposals into action.

Japan Foreign Trade Council

The Japan Foreign Trade Council (JFTC) supports the Paris Agreement and endorses the efforts of the Japanese government and Keidanren to establish a decarbonized society (Plan for Global Warming Countermeasures, and Keidanren Carbon Neutrality Action Plan), and promotes these efforts in cooperation with other industries and organizations. The JFTC has also formulated its own Voluntary Action Plan on the Environment and is working on this as an issue for the trading industry toward building a decarbonized society.

We regard the consideration and implementation of climate change mitigation and adaptation measures to be key issues and actively strive to create new businesses and solutions. In support of the primary objective of the JFTC, we are participating as one of the vice chairman companies of the council. Previously, as the chair of the Global Environment Committee (now the Environment Working Group of the Sustainability Promotion Committee), we played a central role in the Voluntary Action Plan on the Environment.

Regarding the specified consignor system established under the Act on Rationalizing Energy Use, we raised an important issue at a meeting for exchange of opinions between member companies subject to that system and government authorities (the Ministry of Economy, Trade and Industry (METI) and the Agency for Natural Resources and Energy (ANRE)). We currently participate as an observer in the METI/ANRE Working Group on Classification Standards for Consignors, where we have continued making efforts and proposals to create an environment that facilitates the promotion of energy conservation activities with transporters in the revision of the Act on Rationalizing Energy Use.

2030 reduction target for domestic business activities of the trade industry

JFTC has set a target of reducing electricity consumption intensity (electricity consumption per floor space in the entire company) by 15.7% in 2030 compared to the fiscal year 2013. This is based on the effort target required by the Act on Rationalizing Energy Use (to reduce electricity consumption by an average of 1% or more per year over the medium to long term) and is premised on a 1% reduction per year as the maximum target that can be achieved through continued efforts.

As a member of the trade industry group JFTC and its Sustainability Promotion Committee's Environment Working Group, we offer recommendations on the development of a decarbonized society, the realization of a circular economy, and compliance with environmental laws and regulations, and carry out actions toward those goals. In our former position as the chair of the Working Group's predecessor, the Global Environment Committee, we took the leading role in the formulation of the committee's policies.

Battery Association for Supply Chain

We are a member of the Battery Association for Supply Chain (BASC), taking part in its efforts to ensure resource sustainability and further grow the industry. Our COO of the Circular Economy Division, executive officer Masato Ozaki, currently serves as vice president of BASC. In addition to our company, group companies Toyotsu Lithium, Toyota Tsusho Materials, and Toyotsu TEC are also BASC members. Our company represents this association as one its ten managing companies, a role that includes engaging in policy lobbying. In fiscal year 2024, we submitted a set of BASC policy recommendations to the Director-General of the Commerce and Information Policy Bureau of METI.

With the support of METI, the governments of Japan and Canada signed a memorandum of cooperation concerning mineral resources, and a Japanese company signed a memorandum of understanding with a Canadian business aimed at ensuring stable supply of nickel resources. These agreements are expected to strengthen the international resource network.

As an industry association, BASC is contributing to the sustainable growth of the global market by actively making recommendations regarding US Department of Energy policies based on the United States' Inflation Reduction Act and regulatory trends in Europe, among other matters.

In an effort to create a data collaboration platform for the battery industry, BASC joined with 14 Japanese automakers, the Japan Automobile Manufacturers Association, and the Japan Auto Parts Industries Association to establish the Automotive and Battery Traceability Center (ABtC). The ABtC has been certified as a public interest digital platform operator by METI and the Information-technology Promotion Agency, Japan, and plays a vital role in the promotion of digital transformation and streamlining initiatives for the industry as a whole.

The ABtC also actively strives to advance international standardization in order to support the Japanese battery industry's growth and strengthen its competitiveness. It seeks to make the industry sustainable by using the formulation of technical standards as a vehicle for enhancing transparency in the supply chain and boosting Japan's market competitiveness.

Hydrogen Council

Since 2017, we have been a Supporting Member of the Hydrogen Council, a global initiative comprising leading companies in the energy, transport equipment, and financial and investment sectors that share a united, long-term vision for hydrogen as a contributor to the energy transition.

Since hydrogen does not emit CO2 when used, can be produced using biomass or renewable energy, and can be stored, we recognize that it is a strong option toward the achievement of a low-carbon society. As a member of this global council that has many companies that are trying to use hydrogen for decarbonization as members, we can exchange information and opinions widely with other companies that share the ambitious target of decarbonization. Additionally, we collect information related to hydrogen from around the world, with the aim of promoting our hydrogen business and contributing to the achievement of a hydrogen society.

In a landscape where market trends constantly shift and regulations become tighter, we are taking action to help expand hydrogen use around the world and bring forth a hydrogen society. Specifically, we are building a hydrogen utilization model that spans from hydrogen production/supply to the introduction of fuel cell mobility and that will serve domains such as ports, public transportation, and logistics. We are also supporting external sales of fuel cells and the development projects of fuel cell-equipped equipment. Leveraging the insights gained from these activities, we collaborate with the Council's efforts to develop incentives and mechanisms promoting the use of hydrogen and fuel cells, and to formulate unified international standards on hydrogen use, including methods for calculating greenhouse gas emissions.

Japan Hydrogen Association

In Japan, the public and private sectors have long collaborated on hydrogen technology research, development, and demonstration experiments, but the infrastructure for real-world deployment of those technologies remains inadequate and the supply cost is high compared to existing fuels. Consequently, the hydrogen market is still immature.

The Japan Hydrogen Association (JH2A) is an open, cross-industry organization that takes an all-encompassing view of the hydrogen supply chain and works to realize projects for implementing hydrogen technologies in the real world. In doing so, the JH2A aspires toward the early creation of a hydrogen society.

We have been part of this association since its launch in December 2020, and are serving on its Commercialization Committee, Regulatory Committee, and CO2 Free H2 Committee. As one of the leaders, we spearhead the study of various hydrogen supply themes with respect to the feasibility and commercial viability of their concepts.

We also started serving on the Executive Board this fiscal year, and will thus play an in-depth role in the association's operation.

Japan Wind Power Association

The Japan Wind Power Association (JWPA) is a key organization for advancing the spread and development of wind power in Japan. Along with the growing importance of renewable energy in recent years, the JWPA has stepped up its commitment toward the realization of a sustainable society, taking action in the form of policy recommendations, support for technological development, and other initiatives. Past actions include sharing concrete opinions with the Agency of Natural Resources and Energy regarding the 7th Strategic Energy Plan.

Masaru Akiyoshi, Representative Director, Executive Vice President of our group's Eurus Energy Holdings, serves as the JWPA's President, playing the leading role in the association's operation.

Guided by the philosophy of "Helping to preserve the global environment by disseminating and expanding clean energy technologies," Eurus Energy Holdings is working to expand the use of renewable energy. It has a power generation capacity of more than 2 GW in Japan, and roughly 5 GW across 16 other countries. The company is also cultivating the talent needed to spread the adoption of wind power, including through skills development for maintenance technicians and the introduction of international safety training programs.

Liaison Council for Collection of Waste Cooking Oil and Its Utilization as Biofuel for Coastal Vessels

We are cooperating party of the Liaison Council for Collection of Waste Cooking Oil and Its Utilization as Biofuel for Coastal Vessels, which was launched by the Japan Federation of Coastal Shipping Associations, the Japan Passengerboat Association, UCO Japan, and the Japan Railway Construction, Transport and Technology Agency (JRTT) to advance the decarbonization of the coastal shipping industry by promoting the collection of waste cooking oil and expanding the use of biofuel. This initiative represents a pivotal step toward the sustainable growth of the coastal shipping industry.

The government, in its October 2021 revision of the Plan for Global Warming Countermeasures, set a target of reducing the coastal shipping sector's CO2 emissions by 17% in fiscal year 2030 compared to fiscal year 2013. This has sparked interest in the potential of biofuel as one approach for lowering the energy consumption and CO2 emissions of existing vessels. However, currently most of the waste cooking oil of coastal vessels is disposed of, with little progress being made in the utilization of this oil as a biofuel resource.

Working through the liaison council, we are surveying the state of waste cooking oil collection on coastal vessels, in collaboration of the Maritime Bureau of the Ministry of Land, Infrastructure, Transport and Tourism, which participates as an observer, and Daiseki Eco. Solution Co., Ltd., which is a fellow cooperating party. We are using our findings to develop guidelines for operators that collect the waste cooking oil, and to construct a collection system. Our aim is to increase the recovery rate of coastal vessels' waste cooking oil and promote the use of biofuel manufactured from this oil.

We hope that the recovery of waste cooking oil and its use as biofuel will become standard operation procedure for the coastal shipping industry, and thus contribute to the achievement of carbon neutrality for the industry as a whole.

Circular Core

Circular Core is a general incorporated association comprising ten Toyota Group companies, of which five function as the core members: Toyota Motor, Toyota Tsusho, Aisin, Denso, and Toyota Central R&D Labs. It plans to promote the development of a circular economy through three main activities: 1) identification of issues lying between so-called "arterial industries" and "venous industries," 2) exploration and practical development of circular economy-related technologies, and 3) conducting of feasibility studies based on demonstration testing. It is also looking to make advances in the mobility sector in Japan, and, in the medium to long term, partner with other industries and expand the scope of its activities.

Our company, as a key driver of the Toyota Group's circular economy initiatives, has been deeply involved in Circular Core since its launch and is leading the transition to a sustainable society. The current president of Circular Core is one of our executive officers, Masaharu Katayama (COO for Circular Economy Division), who is using his leadership to strengthen the organization's efforts.

Our promotion of circular economy initiatives is aimed at creating value over the long term. Going forward, we will step up our collaboration with Circular Core as we strive to reduce our environmental footprint and to make the most of resources.

Textile Exchange

We are a member of the Textile Exchange, an international nonprofit that was founded to have a positive impact on climate change in the fashion and textile industry. This organization pursues a mission of guiding "a growing global community of brands, manufacturers, and growers towards more purposeful production from the very start of the textile supply chain."

It has a set a goal for the textile industry to achieve a 45% reduction in the greenhouse gas emissions of fiber and raw material production by 2030. To reach that target, Textile Exchange is promoting the adoption of holistic, interrelated approaches for improving water quality, soil health, biodiversity.

Carbon Accounting Adviser Institute

We teamed up with Wastebox, Chubu Electric Power Miraiz, Nippon Life Insurance, and the MS&AD Insurance Group's Aioi Nissay Dowa Insurance to establish the Carbon Accounting Adviser Institute (CAAI) on July 1, 2022 as an organization tasked with promoting correct understanding of climate change-related financial information. We have assigned one of our directors to CAAI and are actively involved in its rulemaking efforts for bringing standardized practices to carbon accounting, which currently lacks a universal set of measurement standards.

The CAAI runs a Carbon Accounting Advisor Qualification System in which Tier 3 and Tier 2 advisors qualify as, respectively, "Decarbonization Advisor Basic" and "Decarbonization Advisor Advanced" under the Ministry of the Environment's Decarbonization Advisor certification program. The system has gained a broad reputation as a very reliable scheme for training carbon accounting talent.

The CAAI is also an Accredited Solutions Provider under the CDP, the global gold standard for climate change disclosures. In this role it helps clients to implement highly sophisticated decarbonization management practices, ranging from visualization of emission levels to formulation of strategies. The CAAI's development of measurement standards and a qualification system for carbon accounting is creating the social infrastructure needed to support decarbonization management by businesses.

We will continue promoting the dissemination of effective accounting rules as part of our sincere commitment to climate change action, with the goal of helping to decarbonize society as a whole.

GX League and GX Acceleration Agency

Established by METI, GX League is a forum for industry-government-academia cooperation in the promotion of GX (Green Transformation) as a path to carbon neutrality in 2050 and to transformation of society. We joined GX League in 2022 as one of its earliest members, and, through our monetary contributions to the GX Acceleration Agency, we are supporting the development of an emissions trading program and other frameworks for the decarbonization market.

As a leader of the energy transition, we are working to accelerate the real-world implementation of GX solutions and to co-create a sustainable future.

Environmental Partnership Organizing Club

We participate in various initiatives as a member of the Environmental Partnership Organizing Club (EPOC), a collaborative organization formed by industry, government, and academia in the Chubu region.

This group works to embed and foster environmental action in society, disseminates information on environmental action, and engages in international exchanges. Through EPOC, we disseminate information on environmental action from Chubu and seek to create a safe and comfortable circular society while establishing a world-class environmentally-advanced region.

CDP

The CDP is a global nonprofit organization that encourages companies and other entities to disclose information on their environmental strategies on climate change, etc., as well as specific figures on greenhouse gas emissions, etc. It provides an important platform that helps companies to track their environmental impact and develop sustainable business strategies.

We endorse the CDP's activities and believe that the questionnaire items which CDP sets serve as essential indicators of environmental performance. Each year we respond to the questionnaire and receive an evaluation, which helps us assess the status of our initiatives. Through this process, we manage our environmental impact and identify areas for improvement.

We will continue striving to improve our environmental performance, using the standards required by CDP as important guidelines.

ISO 50001

We acquired ISO50001:2018 (energy management systems) certification in 2020. This covers our business sites in Japan that are subject to notification requirements as specified businesses under the Energy Conservation Act (18 sites in 11 prefectures) and to our employee benefit facilities. We created energy management standards for each site and periodically check their compliance through energy conservation audits, with the aim of encouraging energy-saving practices.

| Review of Member Organizations We regularly review the policies of the industry associations and initiatives we participate in to ensure they do not diverge from our own policies. If we find any discrepancies, we will approach the associations through constructive dialogue to encourage them to review their stance. |

Performance Data

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | FY2024 | |

|---|---|---|---|---|---|---|---|

| Scope1 | 481,529 | 399,786 | 472,267 | 471,820 | 444,279 | 425,926* | 411,741* |

| Scope2 (Market-base) |

316,058 | 303,832 | 292,531 | 288,990 | 291,509 | 259,939* | 251,070* |

| Scope2 (Location-base) |

321,689 | 304,698 | 293,998 | 300,340 | 305,503 | 302,495* | 280,603* |

| Scope1+2 (Market-base) |

797,587 | 703,618 | 764,798 | 760,810 | 735,788 | 685,865* | 662,811* |

| Scope1+2 (Location-base) |

803,217 | 704,484 | 766,265 | 772,160 | 749,782 | 728,421* | 692,343* |

- *For the scope and conditions of GHG emissions aggregation, please refer here.[PDF:199KB]

| FY2019 (January-December) |

FY2020 (January-December) |

FY2021 (January-December) |

FY2022 (January-December) |

FY2023 (January-December) |

2024 (January-December) |

FY2024 (April-March) |

|

|---|---|---|---|---|---|---|---|

| CO2 | 481,527 | 399,786 | 472,843 | 471,720 | 444,279 | 410,741 | 396,555 |

| CH4/N2O/HFCs/PFCs/SF6/NF3 Others | 0 | 0 | 0 | 0 | 0 | 15,186 | 15,186 |

| Total | 481,527 | 399,786 | 472,843 | 471,720 | 444,279 | 425,926 | 411,741 |

Applies to emissions exceeding 3,000 t-CO2e /gases/subsidiaries per year based on the greenhouse gas emissions accounting, reporting and publication system.

| 2020 | 2021 | 2022 | 2023 | 2024 | FY2024 Assurance acquired |

|

|---|---|---|---|---|---|---|

| Category 1 (Purchased goods and services) | 71,292,740 | 77,588,158 | 72,281,524 | 72,691,490 | ||

| Category 2 (Capital goods)* | 117,711 | 132,184 | 475,206 | 596,373 | 593,227 | 600,247 |

| Category 3 (Fuel-and energy-related activities(not included in scope 1 or scope 2)) | 17,505 | 17,854 | 125,321 | 137,091 | 122,440 | 123,889 |

| Category 4 (Upstream transportation and distribution) | 17,167 | 20,093 | 4,771,390 | 3,460,372 | 3,688,698 | 3,675,618 |

| Category 5 (Waste generated in operations)* | 4,395 | 7,864 | 18,043 | 19,043 | 20,183 | 20,422 |

| Category 6 (Business travel)* | 1,727 | 1,714 | 8,478 | 8,703 | 9,037 | 9,037 |

| Category 7 (Employee commuting)* | 4,218 | 4,212 | 30,256 | 29,323 | 30,576 | 30,576 |

| Category 8 (Upstream leased assets) | 0 | 0 | 0 | 0 | ||

| Category 9 (Downstream transportation and distribution) | 3,007,356 | 4,695,306 | 4,986,476 | 5,149,386 | ||

| Category 10 (Processing of sold products) | N/A | 142,640 | 142,640 | 144,328 | ||

| Category 11 (Use of sold products) | 31,083,460 | 34,244,849 | 28,214,588 | 28,548,462 | ||

| Category 12 (End-of-life treatment of sold products) | 17,931 | 18,060 | 16,893 | 17,093 | ||

| Category 13 (Downstream leased assets) | 38,089 | 22,553 | 25,751 | 26,055 | ||

| Category 14 (Franchises) | 0 | 5,772 | 6,229 | 6,303 | ||

| Category 15 (Investments) | 3,315,383 | 3,160,207 | 3,087,848 | 3,087,848 |

(Before 2021, only categories 2 to 8 were calculated for Toyota Tsusho and domestic consolidated) subsidiaries.

Aggregation period: (2020-2024) January 1 to December 31 each year

(FY2024) April 1, 2024, to March 31, 2025

- *Refferring to the Basic Guidelines for Calculating Greenhouse Gas Emissions through the Supply Chain (Ministry of the Environment and Ministry of Economy, Trade and Industry)

| 2022 | 2023 | 2024 | FY2024 | |

| Biomass fuel consumption (ton) | 228,960 | 228,723 | 231,173* | 224,779* |

| Biomass fuel consumption (kL) | 78 | 2,241 | 1,584* | 1,622* |

| 2022 | 2023 | 2024 | FY2024 | |

| CO2 emissions from biomass fuel use (t-CO2e) | 275,015 | 269,562 | 265,424* | 259,502* |

| 2020 | 2021 | 2022 | 2023 | 2024 | FY2024 | |

| Consumption of fuel (excluding feedstocks) | 1,630,527 | 2,080,177 | 2,787,957 | 2,763,162 | 2,317,551 | 2,247,247 |

| Consumption of purchased or acquired electricity | 643,898 | 605,252 | 676,649 | 670,259 | 680,717 | 674,342 |

| Consumption of purchased or acquired heat | 5,588 | 4,223 | 7,850 | 6,012 | 5,617 | 5,499 |

| Consumption of purchased or acquired steam | 4,267 | 5,122 | 4,987 | 4,911 | 5,621 | 5,041 |

| Consumption of purchased or acquired cooling | 1,506 | 1,438 | 2,022 | 2,437 | 2,611 | 2,593 |

| Consumption of self-generated non-fuel renewable energy | 30,027 | 27,521 | 0 | 0 | 0 | 0 |

| Total energy consumption | 2,315,814 | 2,723,733 | 3,479,466 | 3,446,781 | 3,012,117 | 2,934,722 |

| Total energy consumption | 2020 | 2021 | 2022 | 2023 | 2024 | FY2024 |

|---|---|---|---|---|---|---|

| Total non-renewable energy consumption | 2,285,787 | 2,694,971 | 2,702,936 | 2,661,880 | 2,194,168* | 2,122,317* |

| Total renewable energy consumption | 30,027 | 28,763 | 776,529 | 784,901 | 817,949* | 812,406* |

| Total | 2,315,814 | 2,723,734 | 3,479,465 | 3,446,781 | 3,012,117* | 2,934,722* |

Third Party Certification

Third-party certification has been obtained from LRQA Group Limited for a portion of the performance data above.

(2024)

(FY2024)