For Individual Investors

About us

Growth Strategies

We aim to provide the kinds of value that only the Toyota Tsusho Group can provide, and become an indispensable presence for all stakeholders and wider society. To this end, we have set six key sustainability issues with the aim of achieving sustainable growth through tackling and solving societal issues. These six key sustainability issues include two top-priority issues relating to the building of foundations for corporate growth, and four top-priority issues relating to achieving corporate growth while simultaneously helping to solve societal issues. By aligning the Group's priority areas (strategies) with the latter four top-priority issues, we are aiming to contribute to the solution of societal issues while also achieving sustainable growth.

The Toyota Tsusho Group's Key Sustainability Issues (Materiality)

Seven Priority Areas (Strategies)

-

1Next Mobility Strategy

1Next Mobility StrategyWe are working to expand into the next mobility domain by leveraging our strengths in each of our mobility businesses, which we have collectively nurtured over the years as one of our core businesses, and also working toward electrification, intelligence, and diversification with progress being made in the connected, autonomous, shared, and electric (CASE) revolution.

Further, we continue to strive to make vehicles lighter for the benefit of carbon neutrality and the circular economy. -

2Renewable Energy & Energy Management Strategy

2Renewable Energy & Energy Management StrategyWe have been involved in the renewable energy business since the 1980s, generating electricity around the world from a variety of sources such as wind, solar, hydro, and biomass.

We have Eurus Energy Holdings Corporation, the largest wind power generation company in Japan, and Terras Energy Corporation, a major solar power generation company in Japan. By providing a stable and affordable supply of energy through the creation of systems to adjust and deliver generated power, we will contribute to a better global environment. -

3African Growth Strategy

3African Growth StrategyIn our core mobility business, as a mid- to long-term goal, we are moving toward sales of 500,000 units in 2030, mainly of Toyota vehicles.

And with providing pharmaceuticals and development of a retail business with Carrefour which is the largest retailers in France, based on the philosophy "With Africa, For Africa", we are aiming to contribute to the development of local communities and further strengthen and expand our operational base. -

4Circular Economy Strategy

4Circular Economy StrategyWe have been promoting the circular economy as our business for roughly 50 years since the 1970s.

We believe that "all things are resources," and contribute to the realization of a recycling-based society by collecting waste materials, sorting them, turning them into resources, and carrying out resource recycling to support manufacturing.

We continue to contribute to the automotive industry, manufacturing that is a source of pride in Japan, with high-quality recycled plastic while reducing environmental pollution. -

5Battery Strategy

5Battery StrategyWe are developing our business in all areas of the battery value chain.We are working to stably secure lithium as a raw material for batteries, to handle battery materials such as cathode and anode electrode materials and peripheral components, to participate in battery manufacturing businesses in North America and China, and to engage in the "3Rs" (rebuild, reuse, and recycle) of batteries among other projects.

-

6Hydrogen & Alternative Fuel Strategy

6Hydrogen & Alternative Fuel StrategyThe hydrogen value chain is composed of "produce," "transport," and "use," and our corporate group is particularly focused on "produce" and "use."

We are operating hydrogen stations in Japan, and working to create utilization models for ports, public transportation, and other areas where fuel-cell electric vehicle (FCEV) mobility is intensively used in Japan and overseas. -

7Economy of Life Strategy

7Economy of Life StrategyWe will improve the quality of life in countries and regions where we have strengths by developing businesses that support people's daily lives and contribute to the realization of a highly convenient and healthy society in the future.

As an example, in collaboration with the outdoor products company, we will recycle waste into resources to allow all discarded clothing to be revived into new clothing.

We are working to realize the establishment of a circular economy system in the Economy of Life field.

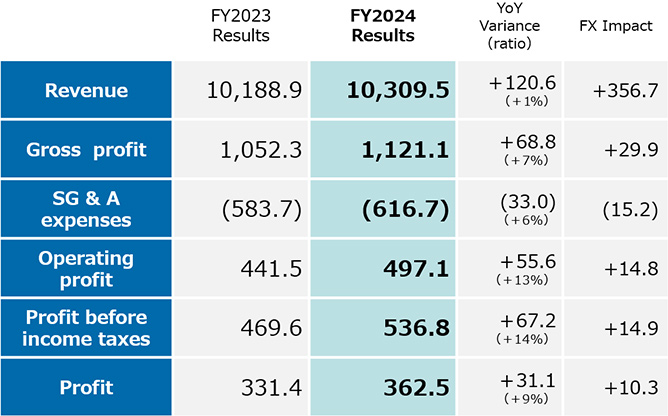

The consolidated financial results for FY2024

Gross profit increased 68.8 billion yen year on year to 1,121.1 billion yen, largely due to increases in changes in model mix of automotive sales in Africa and the yen's depreciation.

Operating profit increased 55.6 billion yen year on year to 497.1 billion yen due to an increase in gross profit, which offset higher selling, general and administrative expenses.

Profit attributable to owners of the parent increased 31.1 billion yen year on year to 362.5 billion yen, largely due to to an increase in operating profit, despite a decrease in the share of profit (loss) of investments accounted for using the equity method caused by the worsening resource market conditions.

We are forecasting full-year profit attributable to owener of the parent of 340.0 billion yen for the fiscal year ending March 31,2026.

Shareholder Returns Policy

The Company's shareholder returns policy is in the period from FY2025 to FY2027, we aim to target a consolidated dividend payout ratio of 40% or more, including share repurchases, while maintaining a progressive dividend.

- ※The new policy will be applied starting from FY2025.

The annual dividend for FY2024 will be applied according to the previous policy*.

*The Company's dividend policy is in the period from FY2023 to FY2025.

We will achieve progressive dividend and consolidated dividend payout ratio of 30% or more.

In addition, agile payment will be considered in situation of cash flow.

For the fiscal year ended March 31,2025, the Company paid a year-end dividends of 55 yen per share. Including the previously paid interim dividend of 50 yen per share, dividends for the fiscal year ended March 31,2025, will be total 105 yen per share.

In accordance with the new shareholder return policy, for the fiscal year ending March 31, 2026, the Company plans to pay annual dividends of 110 yen per share, assuming that it earns 340.0 billion yen of consolidated profit attributable to owners of the parent for the year, in line with its current forecast.