Corporate Governance

- Policy

- Corporate Governance Structure

- Board of Directors Meeting

- Evaluating the Effectiveness of the Board of Directors Meeting

- Initiatives for Enhancing Supervisory Functions

- Board of Directors Advisory Bodies (Executive Appointment Committee and Executive Compensation Committee)

- Audit & Supervisory Board Meeting

- Skill Matrix

- Reasons for Appointment of members of the Board and Meeting Attendance

- Functions and Roles of Committees and Meetings

- Details on Deciding the Compensation, Etc., for Officers and the Calculation Method Thereof, and the Decision Method

- Policy for Investments in Stock

Policy

As part of its fundamental philosophy, Toyota Tsusho Group declares as its corporate philosophy “Living and prospering together with people, society, and the planet, we aim to be a value-generating corporation that contributes to the creation of prosperous societies.” As a good corporate citizen, the group has also established behavioral guidelines as a fundamental code of conduct for realizing this philosophy in a legally compliant and appropriate manner.

In keeping with its fundamental philosophy, the company has set forth the Basic Policies on Establishing Internal Control Systems to pass on and add depth to the Toyota Tsusho DNA, which articulates the unique values, beliefs, and principles of day-to-day conduct of the Toyota Tsusho Group, implementing value creation from a customer perspective, and fulfilling our social mission by establishing systems that ensure proper business processes are followed.

Reflecting these basic policies, the company is actively driving forward with efforts to further improve its management efficiency and transparency, ensure full-fledged compliance, and enhance the soundness of its financial position. Moreover, while we are in full compliance with the various principles of Japan’s Corporate Governance Code, we also earnestly seek to achieve further enhancement to make the content of our actions more substantive, as well-rounded corporate governance is essential for continued corporate growth and a medium- to long-term increase in corporate value.

We believe that providing all our stakeholders with satisfactory added value and contributing to society through our businesses will accelerate the sustainable growth of the Toyota Tsusho Group and thereby lead to corporate value enhancement.

Download for All Pages in PDF format

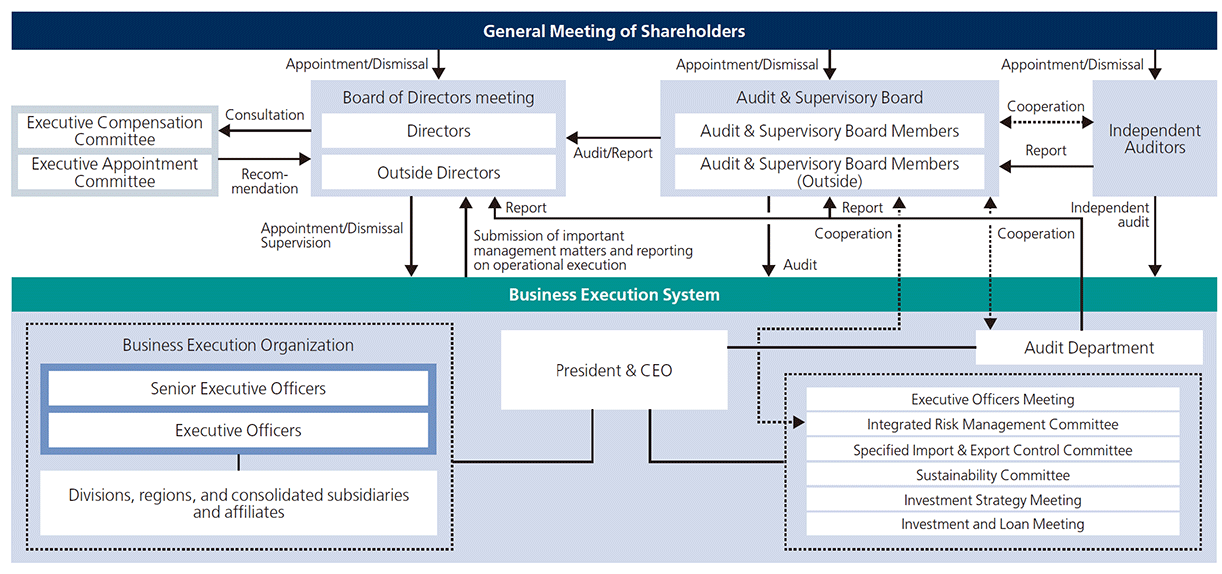

Corporate Governance Structure

Toyota Tsusho has adopted the system of a company with an Audit & Supervisory Board to ensure transparent and sound management and has also introduced an executive officer system to improve management efficiency and strengthen internal control.

The company carries out consolidated management based on a divisional organization that comprises eight sales divisions under the leadership of divisional chief executive officers (CEOs) supplemented by the Administrative Unit.

To enhance independence from the execution of the company’s operations, a non-executive director serves as chairman of the board. At least one-third of the members of the board are independent outside members to strengthen the soundness of management and the functioning and quality of the board, which makes decisions on top-priority management issues and monitors the execution of business. The four outside members of the board (outside directors) include an overseas national and a business entrepreneur, ensuring a continued high level of specialized knowledge, while the inclusion of two female members also contributes to enhancing its diversity.

The division CEOs and the heads of the various Administrative Unit functions are appointed from among the senior executive officers to enable fast-paced management that is in close contact with frontline operations. To boost expertise, we have established the positions of chief financial officer (CFO), chief strategy officer (CSO), chief human resources officer (CHRO), chief technology officer (CTO), and Chief Safety & KAIZEN Officer (CSKO), who bear ultimate responsibility for their respective functions. By reinforcing governance functions and clarifying roles and responsibilities, this facilitates the exercise of high levels of specialization and expedites decision-making.

Toyota Tsusho expressed its support for the "Challenge for 30 percent by 2030" promoted by the Japan Business Federation (Keidanren). This challenge sets a target of filling at least 30% of positions on the Board of Directors, a key corporate decision-making body, with women by 2030.

Board of Directors Meeting

Number of Meetings in FY2024:14

The Board of Directors meeting, which comprises nine members, including four outside members, makes decisions on top-priority management issues and monitors the execution of business. The company has submitted notification that three of the four outside members of the board satisfy the criteria for independence as specified by Japanese stock exchanges. Moreover, the independence of the Board of Directors meeting is enhanced by having a non-executive director serve as chairman. Members of the board are appointed for a one-year term, and the Board of Directors meeting in principle meets once a month.

| Topic | Main resolutions and reports |

|---|---|

| Management strategy |

|

| Corporate governance |

|

| Supervision of business execution |

|

| Investments and loans |

|

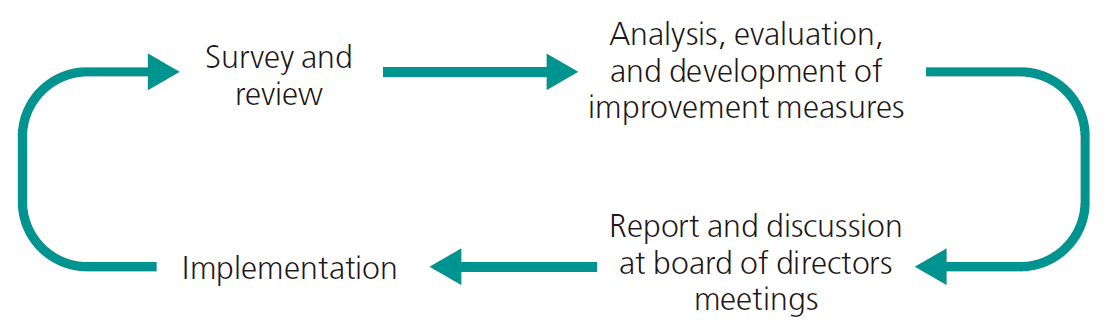

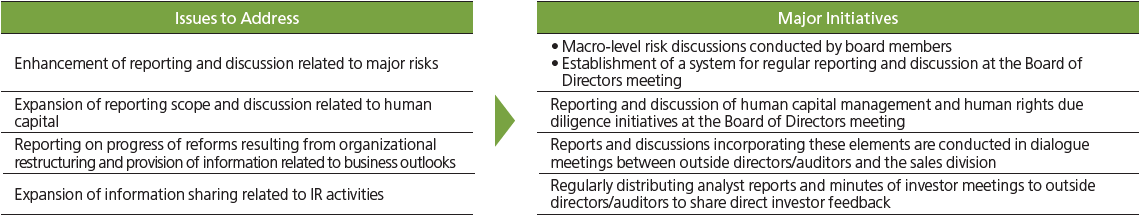

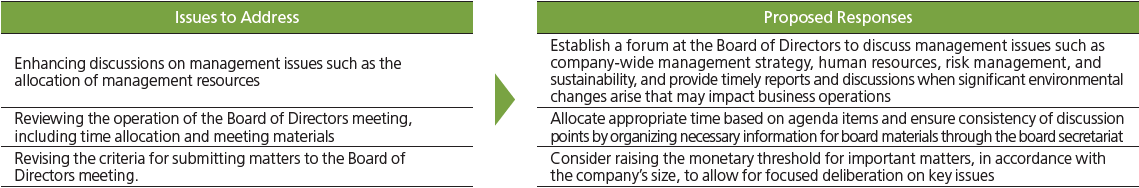

Evaluating the Effectiveness of the Board of Directors Meeting

Evaluation Overview

Toyota Tsusho evaluates the effectiveness of the Board of Directors meeting annually to continue to maintain and improve the effectiveness of its corporate governance.

| Respondents | All eight members of the board and all five Audit & Supervisory Board members |

|---|---|

| Priority Topic | Further improvement of the effectiveness of the board of directors meetings |

| Evaluation items |

|

Results of Evaluating the Effectiveness of the Board of Directors Meeting

Questionnaire responses were generally positive across all of the matters evaluated, confirming the effectiveness of the Board of Directors meeting.

Initiatives for Enhancing Supervisory Functions

The company has established a support framework so that outside directors can participate in board discussions and satisfactorily fulfill their management advisory and supervisory functions. The Board of Directors Meeting Secretariat sends out board of directors meeting materials in advance and holds advance briefings with departments proposing agenda items so that outside directors have a firm understanding of business details.

For the main matters discussed at board of directors meetings, on-site observations for the outside directors/auditors are arranged to further improve their understanding of the Company. In the fiscal year ending March 2025, outside officers visited India to inspect Sakura World Hospital, operated by Secom Medical System Co., Ltd., as well as automotive-related business entities.

Board of Directors Advisory Bodies (Executive Appointment Committee and Executive Compensation Committee)

Number of Meetings in FY2024: 3 (Executive Appointment Committee), 4 (Executive Compensation Committee)

Toyota Tsusho has established the Executive Appointment Committee and the Executive Compensation Committee as advisory bodies to the Board of Directors meeting. Both committees are chaired by the chairman of the board, who does not hold representative rights and has no involvement in operational execution. Each committee comprises five members—three independent outside members of the board and two internal members of the board. The majority of each committee being made up of independent outside members of the board enhances the objectivity and transparency of each committee.

The Executive Appointment Committee deliberates on the appointment and dismissal of members of the board and, Audit & Supervisory Board members and senior executive officers. It also discusses proposed executive personnel plans, as well as the formulation and operation of CEO successor development plans and other important matters related to executive appointments. The Executive Compensation Committee deliberates on the policy for determining the details of compensation for each member of the board, the compensation system, compensation proposals to be submitted to the General Meeting of Shareholders, and other important matters concerning the compensation of members of the board and Audit & Supervisory Board members.

< Members of Both Committees > As of June 21, 2024

| Executive Appointment Committee | Executive Compensation Committee | |

|---|---|---|

| Committee Chairman | Nobuhiko Murakami (Chairman of the board) | Ichiro Kashitani (Vice Chairman of the Board) |

| Committee member | Toshimitsu Imai (President & CEO) | Toshimitsu Imai (President & CEO) |

| Committee member | Yukari Inoue (Outside member of the board) | Yukari Inoue (Outside member of the board) |

| Committee member | Chieko Matsuda (Outside member of the board) | Chieko Matsuda (Outside member of the board) |

| Committee member | Goro Yamaguchi (Outside member of the board) | Goro Yamaguchi (Outside member of the board) |

Audit & Supervisory Board Meeting

Number of Meetings in FY2024:14

The Audit & Supervisory Board, which comprises five members (three of whom are independent outside Audit & Supervisory Board members), provides a checking function from an external viewpoint. All Audit & Supervisory Board members regularly exchange opinions with board members, including outside members of the board, executive officers, and an independent auditor, as well as with the Audit Department and other entities. In this way, Audit & Supervisory Board members strive to ensure the legality, appropriateness, and efficiency of business execution. The Audit & Supervisory Board meets in principle once a month. Audits conducted by Audit & Supervisory Board members are carried out per the audit policies and plans approved by the Audit & Supervisory Board and reported to the Board of Directors meeting. Audit & Supervisory Board members implement audits on the execution of duties by members of the board. An audit is also conducted regarding the appropriateness of the results of the inspection by the independent auditor. Dedicated staff members are assigned to assist with the duties of Audit & Supervisory Board members, including outside auditors.

Skill Matrix

Toyota Tsusho will pursue its “Be the Right ONE” vision to shape the future. By doing so it aims to create distinctive forms of value that contribute to society and protect the environment and thereby establish business domains linked to its unique strengths. Toward this goal, the Board of Directors meeting has established a skill matrix covering the expertise required of members of the Board and Audit & Supervisory Board members to enable the Board of Directors meeting to make decisions and supervise management appropriately.

The capabilities and experience of board and Audit & Supervisory Board members are as below.

In addition to their expertise and wealth of experience, the Board of Directors meeting boasts a diverse composition in terms of gender, nationality, and other attributes, providing a structure that can flexibly adapt to various changes in the business environment.

| Required skills | Reasons for the selection of these skills |

|---|---|

| Business management | Experience involving corporate management is required in order to make proper management decisions for the consistent growth of corporate value as the business climate changes rapidly. |

| Global | The Toyota Tsusho Group operates in more than 130 countries and regions. Consequently, extensive knowledge and experience involving job postings in other countries and life styles, culture, business climates and other aspects of other countries are required. |

| Sales/Marketing | The Toyota Tsusho Group must accurately identify and meet a broad range of customer needs as a trading company handling many types of products. This requires sales and marketing expertise along with a thorough understanding of numerous markets. |

| Finance/Accounting | Knowledge and experience involving finance and accounting are required in order to make strategic investments for sustained growth and other goals while using capital more efficiently and preserving financial soundness. |

| Legal/Risk management | Expertise and experience involving legal affairs and risk management are required for the purposes of maintaining corporate governance for sustained growth and the medium to long term growth of corporate value and of establishing a risk management framework for supporting business operations, including activities in emerging countries in Africa and other regions. |

| Technology/Digital | Knowledge and experience involving new technologies and services, including information technology and the digital transformation, are required in order to benefit from advances in technologies, especially in the field of mobility. |

| Sustainability | Sustainability is an integral component of management at the Toyota Tsusho Group. Knowledge and experience are required concerning ESG issues and for achieving the sustained growth of corporate value from a long term perspective. |

| Name | Position | Business management | Global | Sales/ Marketing |

Finance/ Accounting |

Legal/Risk management | Technology/ Digital |

Sustainability | ||

|---|---|---|---|---|---|---|---|---|---|---|

| Members of the Board | Internal | Nobuhiko Murakami | Chairman of the Board | 〇 | 〇 | 〇 | 〇 | |||

| Ichiro Kashitani | Vice Chairman of the Board | 〇 | 〇 | 〇 | 〇 | |||||

| Toshimitsu Imai | *President & CEO | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Hideyuki Iwamoto | *Member of the Board | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Tatsuya Watanuki | *Member of the Board | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Outside | Didier Leroy | Outside Member of the Board | 〇 | 〇 | 〇 | 〇 | ||||

| Yukari Inoue | Outside Member of the Board | 〇 | 〇 | 〇 | 〇 | |||||

| Chieko Matsuda | Outside Member of the Board | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Goro Yamaguchi | Outside Member of the Board | 〇 | 〇 | 〇 | 〇 | 〇 | ||||

| Audit & Supervisory Board members | Internal | Kentaro Hayashi | Audit & Supervisory Board member (full time) | 〇 | 〇 | 〇 | 〇 | |||

| Kazuya Kawashima | Audit & Supervisory Board member (full time) | 〇 | 〇 | 〇 | ||||||

| Outside | Tsutomu Takahashi | Outside Audit & Supervisory Board member |

〇 | 〇 | 〇 | |||||

| Seishi Tanoue | Outside Audit & Supervisory Board member |

〇 | 〇 | 〇 | ||||||

| Rikako Beppu | Outside Audit & Supervisory Board member |

〇 | 〇 | 〇 | ||||||

Reasons for Appointment of members of the Board and Meeting Attendance

| Name/Reason for appointment | Number of Board meetings attended | |

|---|---|---|

| Members of the Board |

Nobuhiko Murakami Mr. Nobuhiko Murakami has served as an officer for Toyota Motor Corporation and SUBARU Corporation, and was mainly engaged in global management and marketing. He has expertise in the automobile industry, with a wealth of experience in global management. The Company has nominated Mr. Murakami as a director based on the belief that he can provide advice about the Company’s businesses and supervise the execution of duties by directors by using a viewpoint separate from that of managers of business operations after he became Chairman of the Board in June 2022. |

14/14 |

| Ichiro Kashitani Mr. Ichiro Kashitani has experience in the automotive, food, Africa, corporate and other business units and had been President & CEO for seven years since April 2018. His outstanding management skills and leadership have made a big contribution to the growth of corporate value. He has a wealth of experience in global management and advanced knowledge of overall management. By using these skills, he is expected to provide advice about business operations and supervise the execution of duties by directors from a viewpoint that is separate from the management of business operations. For these reasons, The Company has nominated him as a director. |

14/14 | |

| Toshimitsu Imai Mr. Toshimitsu Imai has been involved primarily with the mobility business and has experience as the vice president of CFAO, Managing Officer (Chief Executive Officer, Africa Division)of Toyota Motor Corporation, and COO of the Africa Division of Toyota Tsusho. Subsequently, he was the executive vice president and CTO of Toyota Tsusho and was named President & CEO in April 2025. Mr. Imai has advanced knowledge of overall management backed by many years of experience concerning global management. He is expected to use these skills to contribute to the growth of corporate value. For these reasons, The Company has nominated him as a director. |

ー | |

| Hideyuki Iwamoto Mainly engaged in accounting, finance and corporate planning fields at the Company, Mr. Hideyuki Iwamoto currently serves as CFO. The Company has nominated Mr. Iwamoto as a director because he has a wealth of experience in global management and has advanced knowledge of overall management, particularly in the fields of finance, accounting, and risk management, and is able to contribute to the enhancement of the Company’s corporate value. |

14/14 | |

| Tatsuya Watanuki Mr. Tatsuya Watanuki was initially assigned to the electronics sector and subsequently was vice president of the India subsidiary and Regional CEO of East Asia Region. He was named executive vice president in April 2024 and is CEO of the Lifestyle Division. Mr. Watanuki has advanced knowledge of overall management backed by many years of experience concerning global management. He is expected to use these skills to contribute to the growth of corporate value. For these reasons, The Company has nominated him as a director. |

ー | |

| Outside Members of the Board |

Didier Leroy Served as an officer for Toyota Motor Corporation and its affiliates and thus has abundant management experience and advanced expertise in global management, particularly in the automobile industry. His appointment as an outside member of the board is maintained with the expectation that he will apply this experience and expertise to provide advice on all aspects of company business and management and to supervise the execution of duties by directors. |

14/14 |

| Yukari Inoue Served as Vice president & managing director Japan, Korea, Taiwan & Hong Kong, Kellogg AMEA and as an officer of global companies and thus has abundant management experience and advanced expertise in global management, particularly in the field of consumer-oriented business. Her appointment as an outside member of the board is maintained with the expectation that she will apply this experience and expertise to provide advice on all aspects of company business and management and to supervise the execution of duties by directors. |

12/14 | |

| Chieko Matsuda Has experience working at a bank and credit rating agency, in the field of research, and as an outside director of an operating company. This has given her abundant experience and advanced expertise in corporate management, finance, and corporate governance in particular. Her appointment as an outside member of the board is maintained with the expectation that she will apply this experience and expertise to provide advice on all aspects of company business and management and to supervise the execution of duties by directors. |

14/14 | |

| Goro Yamaguchi Served as president and representative director and chairman of the board of Kyocera Corporation, a major manufacturer of electronic components and devices, and thus has abundant management experience and advanced expertise in global management, particularly in the field of electronics. His appointment as an outside member of the board with the expectation that he will apply this experience and expertise to provide advice on all aspects of company business and management and to supervise the execution of duties by directors. |

11/11*1 |

- *1Goro Yamaguchi assumed office on June 21, 2024 (the date of the 103rd Ordinary General Meeting of Shareholders). Therefore, the number of Board of Directors meetings attended differs from that of other directors.

Functions and Roles of Committees and Meetings

Toyota Tsusho has established a variety of committees and meetings to strengthen its corporate governance.

Key Committees and Meetings

| Key Committees and Meetings | Role | Frequency of meeting |

|---|---|---|

| Executive Officers Meeting | Exchange information, share reports on management issues between top management and operating officers | Once a month |

| Integrated Risk Management Committee | Identify important company-wide risks related to management objectives, discuss and determine countermeasures, and provide Executive Committees with recommendations on issues related to company-wide risk management | Three times a year |

| Specified Import & Export Control Committee | Determine the overall direction of matters related to transaction control of restricted cargo and import/export regulation | Once a year |

| Sustainability Management Committee | Establish the structure to promote our activities aimed at sustainability for the environment and society, share information, discuss the implementation plans and monitor the progress for our sustainability initiatives | Once a year |

| Investment Strategy Meeting | Discuss investment strategies | Once a month |

| Investment & Loan Committee / Meeting | Discuss investment and lending projects | Investment & Loan Committee: Three times a month Investment & Loan Meeting: Four times a month |

Details on Deciding the Compensation, Etc., for Officers and the Calculation Method Thereof, and the Decision Method

(1) Overview of the Compensation System for Members of the Board

Compensation for members of the Board of Toyota Tsusho consists of fixed remuneration as basic compensation, bonuses as performance-linked compensation, and restricted stock compensation.

However, given that outside members of the Board are independent of operational management, they are paid fixed remuneration only and are not paid bonuses or restricted stock compensation.

(2) Method of Determining the Amount of Compensation for Each Member of the Board

Toyota Tsusho has established the Executive Compensation Committee as an advisory body to the Board of Directors. To enhance its objectivity and transparency, the committee is chaired by chairman of the Board or vice chairman of the Board, neither of whom is involved in operational management, and its members are comprised of a majority of independent outside members of the Board.

The Executive Compensation Committee deliberates on the policy for determining the details of compensation for each member of the Board (hereinafter, “the policy”), the executive compensation system, executive compensation proposals to be submitted to the General Meeting of Shareholders, and other important matters concerning executive compensation. Based on the results of deliberations by the committee, the Board of Directors resolves important matters concerning executive compensation, including the policy and proposals to be submitted to the General Meeting of Shareholders.

From the perspective of making flexible and agile decisions on the amount of compensation for each member of the Board in relation to fixed remuneration and bonuses, the Board of Directors delegates that decision to the president & CEO. Based on the opinions gathered during interviews with each member of the Executive Compensation Committee regarding the proposed amount of compensation for each member of the Board, the president & CEO determines the amount of fixed remuneration and the amount of bonuses for each member of the Board in accordance with the policy. Individual compensation amounts in relation to restricted stock compensation are also resolved at the Board of Directors meeting.

(3) Policy for Determining the Ratio of Fixed Remuneration, Bonuses, and Restricted Stock Compensation

The ratio of performance-linked compensation (bonuses and restricted stock compensation) to fixed remuneration for members of the Board, excluding outside members of the Board, shall increase as the amount of consolidated profit for the year attributable to owners of the parent for the previous fiscal year increases. The ratio of bonuses to performance-linked compensation (hereinafter, “the bonus ratio”) and the ratio of restricted stock compensation to performance-linked compensation (hereinafter, “the RS ratio”) are resolved at the Board of Directors meeting, based on the results of deliberations by the Executive Compensation Committee and in accordance with roles and responsibilities.

(4) Policy for Determining the Amounts of Fixed Remuneration and Bonuses

Fixed remuneration for members of the Board shall be a monthly remuneration, paid periodically throughout their tenure. Individual fixed remuneration amounts are set at an appropriate level, taking into consideration the position and responsibilities of each member of the Board, with reference to the remuneration data of other companies in the industry as a benchmark.

Bonuses are paid at a fixed time of the year after the conclusion of the General Meeting of Shareholders for each fiscal year. Given that members of the Board are responsible for the final profit (including temporary and incidental gains/losses) of all Toyota Tsusho Group companies, the consolidated profit for the year attributable to owners of the parent for the previous fiscal year is used as an indicator for individual performance-linked compensation amounts. Individual bonus amounts for each fiscal year are calculated by multiplying the amount of performance-linked compensation—which is determined for each position according to the indicator—by the bonus ratio. The president at the end of the previous fiscal year proposes the bonus amounts as needed based on the responsibilities of the position and the performance of the duties for which each individual is responsible, and the president & CEO at the time of bonus payment makes the decision based on that proposal.

The total amount of fixed remuneration and bonuses shall be within the limit resolved at the General Meeting of Shareholders.

(5) Policy for Determining the Amount of Restricted Stock Compensation

Restricted stock compensation is granted at a fixed time of the year after the conclusion of the Ordinary General Meeting of Shareholders for each fiscal year. However, in cases in which it is not appropriate to grant restricted stock compensation to eligible members of the Board, the full amount of the performance-linked compensation for eligible members of the Board shall be paid as a bonus and no restricted stock compensation shall be granted.

The compensation paid for the granting of restricted stock compensation shall be a monetary claim, the total amount of which shall be within the limit resolved at the General Meeting of Shareholders, separate from the fixed remuneration and bonuses for members of the Board. The class of stock to be allocated shall be common shares (those for which restriction is imposed in an allocation agreement) issued or disposed of, and the total number of shares shall be within the limit resolved at the General Meeting of Shareholders.

Amounts of individual restricted stock compensation paid in each fiscal year are calculated by multiplying the performance-linked compensation—which is determined for each position according to the indicator—by the RS ratio, and are resolved at the Board of Directors meeting.

(6) Compensation for Audit & Supervisory Board Members

Regarding compensation for Audit & Supervisory Board members, given their independence for carrying out audits appropriately, only fixed remuneration is paid. Amounts of compensation are determined through discussion among Audit & Supervisory Board members, within the limit resolved at the General Meeting of Shareholders.

| Executive category | Total amount of compensation and other remuneration (Millions of yen) | Total amount per type of compensation (Millions of yen) | Number of eligible officers | ||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked compensation | ||||

| Bonuses | Restricted stock compensation | ||||

| Members of the Board (Outside members of the board) | 770 (57) |

260 (57) |

266 (ー) |

243 (ー) |

9 (5) |

| Audit & Supervisory Board members (Audit & Supervisor Board members (Outside)) | 126 (43) |

126 (43) |

ー (ー) |

ー (ー) |

6 (4) |

| Total(Outside officers) | 897 (100) |

387 (100) |

266 (ー) |

243 (ー) |

15 (9) |

- 1The above includes one outside member of the board and one audit & supervisor Board member (Outside) who retired at the close of the 103rd Ordinary General Meeting of Shareholders held on June 21, 2024

- 2The details of the resolutions of the General Meeting of Shareholders regarding remuneration, etc. are shown in the table below.

| Type of compensation | Limit of remuneration | General meeting of shareholders resolution | Number of directors at the time of the resolution | |

|---|---|---|---|---|

| Members of the Board | Fixed remuneration Bonuses |

Up to 1.5 billion yen per year (Of which, up to 200 million yen for outside members of the board) | June 20, 2025 104th Ordinary General Meeting of Shareholders |

Members of the Board:9 (Outside members of the board:4) |

| Restricted stock compensation | Up to 1 billion yen per year (Up to 1.5 million shares per year) | June 20, 2025 104th Ordinary General Meeting of Shareholders |

Members of the Board:9 (Outside members of the board:4) |

|

| Audit & Supervisory Board members | Fixed remuneration | Up to 16 million yen per month | June 20, 2014 93rd Ordinary General Meeting of Shareholders |

Audit & Supervisory Board members:5 (Audit & Supervisor Board members (Outside):3) |

Policy for Investments in Stock

Policy for stock ownership for business relationships

Maintaining and strengthening business and collaborative relationships with a variety of companies is necessary for the sustainable enhancement of Toyota Tsusho’s corporate value. The company owns on a limited and strategic basis the stock of important suppliers and other partners where it believes that the ownership of this stock is beneficial and important from a medium- to long-term perspective (shareholding). Once every year, the Board of Directors meeting receives a report about the results of a reexamination of stock holdings and if stock should be retained or sold. It reduces holdings of stocks where ownership is not beneficial.

Examination of justification of stock shareholdings

Toyota Tsusho uses an indicator of its own, which is based on the cost of capital, to determine comprehensive assessments of stock holdings. Assessments incorporate profitability; building, preserving, and reinforcing business relationships; contributions and cooperation for regional and social progress; and other considerations. This process is used to decide if the company should continue to hold a stock and to reexamine the number of shares held.

As needed, constructive dialogues take place with companies in which stock is held from the standpoint of preserving and increasing corporate value and achieving sustainable growth. These dialogues facilitate the sharing of information about management issues and making improvements.

Policy on the exercise of voting rights

Striving to maintain and strengthen partnership with investee companies, Toyota Tsusho engages in communications with these companies that contribute to enhancement of their shareholder interests and corporate value over the medium and long term. Toyota Tsusho’s departments that manage investments take that perspective and appropriately exercise voting rights on the basis of multifaceted and comprehensive consideration of the situation of each investee company.

Policy for when cross-shareholders indicate that they want to sell the shares

If cross-shareholders (i.e. shareholders who hold a share of Toyota Tsusho for the purpose of cross-shareholding) seek to sell the shares, Toyota Tsusho will not hinder the sale of the cross-held shares. In such a case, if Toyota Tsusho has their shares for the purpose of cross-sharing, it will take appropriate measures to reduce those shares in accordance with the Company's policies on cross-shareholdings.