Compliance

Policy

Toyota Tsusho endeavors to ensure that executives and employees (including full-time employees, part-time employees, contract employees, temporary employees, and seconded employees, etc.; the same applies to the following) perform their duties in accordance with laws, regulations, the company's Articles of Incorporation, and corporate ethics as the basic policy for compliance.

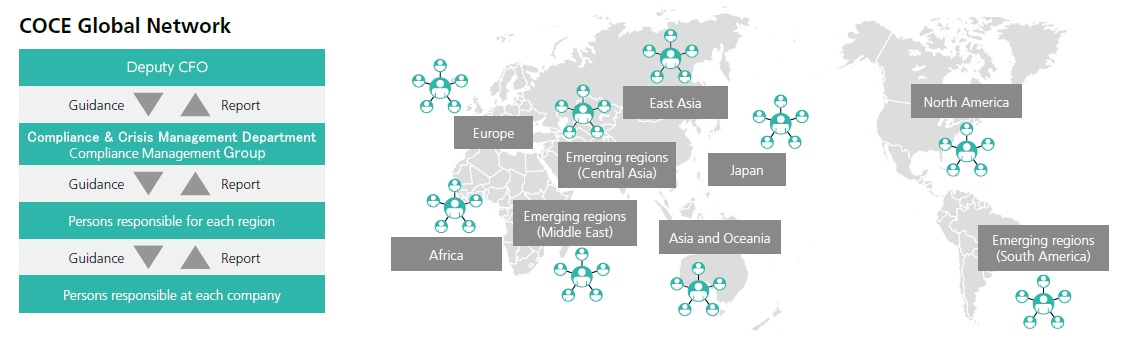

In July 2016, Toyota Tsusho enacted its Global Code of Conduct & Ethics (COCE), which defines the company's behavioral guidelines, after it was approved by the Board of Directors in April of that year. We ensure that all executives and employees understand and comply with the COCE by issuing a message from the president, publishing the 'COCE Booklet' in various languages (23 languages), and conducting awareness activities through our global network. Additionally, we conduct COCE training for executives and employees both domestically and internationally and obtain a pledge of compliance with COCE every year.

Violation of Global Code of Conduct & Ethics (COCE)

We require all officers and employees to report any concerns about possible COCE violations promptly through the proper channels, and we guarantee that no retaliatory actions or measures will be taken against the reporter pursuant to internal regulations. The proper channel includes supervisors and the Administrative Unit, as well as our global whistleblower system (described below), which accepts anonymous reporting in more than 150 languages.

On-site inspections by the planning department of each sales division and internal audits by the Audit Department also carefully look for COCE violations.

In addition, starting from the fiscal year ending March 2024, we have initiated the 'Safety and Compliance Comprehensive Inspection' activities for our major consolidated subsidiaries. In these activities, each company disseminates top management messages and information about our global whistleblower system, and inspects the status of obtaining necessary permits and licenses for their operations and compliance with quality standards related to their products and services. Following these inspections, the responsible executives from Toyota Tsusho verify the implementation status on-site.

We also fully utilize the latest digital tools, such as IT and AI, to analyze a massive amount of data on expenses, sale and purchase accounting and financial statements, etc., and monitor for signs of improper conduct so we can prevent and discover them early. These analysis results are also utilized in the aforementioned on-site inspection activities and internal audits.

If there is a concern about a possible COCE violation, the Compliance & Crisis Management Department, together with related departments such as the Legal Department and the Global Human Resources Department, thoroughly investigate the case and take appropriate action based on the Incident Response Manual, under the supervision of the Board of Directors. To maintain our compliance-related initiatives at the highest level, we will continue to regularly evaluate and validate the current basic policies, the COCE, and the effectiveness of various compliance measures and improve them as needed.

The number of COCE violations in the Toyota Tsusho Group in Japan and overseas in the fiscal year ended March 31, 2024, is shown here below. Note that there were no violations seriously affecting our group’s operation.

| Area | Number of breaches |

|---|---|

| Legal violations (Subcontract Act, permits and licenses, etc.) | 15 |

| Embezzlement | 9 |

| Harassment | 5 |

| Bad conduct/Injury | 13 |

| Violations of personal data protection | 4 |

| Bribery | 0 |

| Conflict of interest transactions | 0 |

| Money laundering/Insider trading | 0 |

| Others (Employment regulation violations) | 1 |

| Total number of cases | 47 |

Anti-Corruption

1. Basic Policy

The Toyota Tsusho Group clearly states its anti-corruption policy in the Global Code of Conduct & Ethics (COCE), and prohibits corruption and prevents money laundering as its Anti-Corruption Policy.

- 1Corruption refers to all acts of abuse of authority in search of unfair profits, and includes all forms of corruption such as bribery, cartels/bid-rigging, embezzlement, and conflicts of interest.

- 2Bribery refers to the improper provision of money, gifts, entertainment or other benefits to civil servants or private individuals, or promises to provide them or the act of making such promises, to obtain or secure business benefits, whether directly or indirectly.

- 3Bribery refers to the request or receipt of money, gifts, entertainment or other benefits in return for improper judgment or conduct, whether directly or indirectly.

2. Supervision by the Board of Directors

Upon COCE violations, the Compliance & Crisis Management Department, together with related departments such as the Legal Department and the Global Human Resources Department, thoroughly investigate the case and take appropriate action based on the Incident Response Manual, under the supervision of the Board of Directors. Furthermore, at the Integrated Risk Management Committee Meeting held once every quarter and chaired by the Board of Directors and the member of the board & CFO, the policy for our global compliance activities including anti-corruption initiatives is reported along with the status of activities and violations in the current fiscal year.

3. Specific Initiatives

The Toyota Tsusho Group has established bribery prevention rules and implementation guidelines and is endeavoring to prevent bribery by ensuring that there are no breaches of the bribery regulations of any country, including the Foreign Corrupt Practices Act of the United States, the Bribery Act 2010 of the United Kingdom, and the Unfair Competition Prevention Act of Japan. Specifically, we are obliged to pre-examine and approve transactions involving the government, pre-examine and approve invitation of public officials, and report provision of entertainment and gifts to public officials. In addition, in order to prevent money laundering, payments to third countries and third parties are prohibited in principle, and the approval procedures for special approval are stipulated. We also regularly monitor the status of compliance with these internal rules and strive to ensure thorough compliance with these rules, and also improve them.

As part of the above-mentioned approval procedures, we conduct following due diligence for existing and new agencies (agencies, agents, consultants, etc.), suppliers, joint ventures, and joint venture partners, equivalent to their risk assessment. In addition, with new business partners and existing business partners associated with corporate acquisitions and joint ventures, we inform them of the Group's anti-corruption policy so they understand the Group's strong determination to prevent corruption. As a general rule, we conclude a contract that includes a clause on anti-bribery and obliges the new and existing business partners to the prevention of corruption, including bribery, thereby preventing the occurrence of corruption.

- 1Pre-contract confirmation of business partner's anti-bribery system through Anti-Bribery & Corruption Questionnaire

- 2Checking bribery controversies of business partners using the third-party risk and compliance database

- 3Background survey on bribery and corruption risk of the business partner by a third-party

Regarding group companies, each business entity annually evaluates on two axes of its corruption risks, including bribery, with reference to its business domain, business partner and the Corruption Perceptions Index (CPI) published by Transparency International, and management system for the risks. Based on the results of the evaluation, in consultation with local attorneys regarding the laws and regulations of each country, each business entity establishes related internal rules including anti-bribery rules, and implement similar initiatives as described above, such as approvals and reporting procedures, due diligence of business partners, and utilizing e-learning of external organizations which we contract. In particular, for group companies evaluated as having a high risk, the Compliance & Crisis Management Department of the head office conducts interviews, etc. in collaboration with local legal representatives and legal personal and then provides guidance and support so that the above efforts can be properly designed, implemented, and carried out. The Compliance & Crisis Management Department of the head office monitors the implementation and execution status of these efforts and support them to prevent corruption.

Confirmation of Contributions to Industry Associations and Other Organizations

We communicate opinions that may influence the enactment or revision of laws to the government through our participation in various committees and working groups of industry associations. Payments to such industry associations and other organizations are subject to prior approval, and we confirm that the contribution payments are appropriate.

| Fiscal year ended March 31, 2021 |

Fiscal year ended March 31, 2022 |

Fiscal year ended March 31, 2023 |

Fiscal year ended March 31, 2024 |

|

|---|---|---|---|---|

| Contributions to Industry Associations and Other Organizations | 179 | 189 | 200 | 200 |

| Japan Business Federation Committee on Africa |

The Committee on Africa aims to promote economic exchange and development between Japan and Africa through cooperation between Japanese business circles, African political and business circles, and relevant Japanese ministries and agencies. Specifically, the Committee has dispatched missions to Africa, participated in TICAD and the Japan-Africa Public-Private Economic Forum , introduced proposals for African development to Japanese and African political and business circles, and engaged in exchanges with African political and business leaders and Japanese ministries and agencies involved in Africa. We have held the position of Co-Chair since May 2017 and are actively spearheading the above-mentioned activities. In February 2023, we led a mission to South Africa, Angola, and Ethiopia where we deepened exchanges with political and business communities in each country. |

|---|---|

| THE TOKYO CHAMBER OF COMMERCE AND INDUSTRY The Japan-Egypt Business Council |

The Council aims to promote economic exchange and development between Japan and Egypt through cooperation between Japanese business circles, Egyptian political and business circles, and relevant Japanese ministries and agencies. Specifically, the Council has dispatched missions to Egypt, held the Joint Conference of the Japan-Egypt & Egypt-Japan Business Councils , and engaged in exchanges with Egyptian political and business leaders and relevant Japanese ministries and agencies involved in Egypt. We have held the position of Chair since December 2013 and are actively spearheading the above-mentioned activities. In March 2019, we sent a mission to Cairo jointly with the Japan External Trade Organization (JETRO) where we met with the President and other key ministers and deepened exchanges with Egyptian business community. In April 2023, a Japan-Egypt Business Forum was held in Cairo and was attended by visiting Prime Minister Kishida and Prime Minister Madbouly . |

| The Japan Iron and Steel Federation | The Japan Iron and Steel Federation (JISF ) is a private organization established as a comprehensive survey and research organization for the iron and steel industry. It conducts business activities with the aim of promoting the sound production, distribution, consumption, and trade of iron and steel, and contributing to the development of the Japanese economy and improvement of people's lives. Examples of its business activities include various surveys and research, improvement of technological development and promotion of its widespread use, and promotion of standardization. We serve as a non-executive director of JISF and participate in activities such as market research on iron and steel, carbon neutrality, international cooperation, and product safety. |

4. Training

The Laws & Ordinances Handbook for Executives and a compliance manual for employees also clearly describe the prohibition of corrupt acts and are distributed in handbooks and other forms to all executives and employees, respectively. Also, to ensure full understanding and thorough dissemination of the requirements, we offer an e-learning course that is mandatory for all executives and employees.

Additionally, for managerial staff, we have created a handbook outlining fundamental practices to be implemented for the prevention of corruption, and we ensure thorough understanding and adherence through training sessions and other means.

5. Individual Response to COCE Violations

To handle emergencies when a COCE violation occurs, the Toyota Tsusho Group has established emergency response guidelines (in a form of notification) and the Compliance & Crisis Management Department takes appropriate action at the appropriate time together with the related departments.

Upon receiving the report, the Compliance & Crisis Management Department General Manager immediately reports to the top management, Deputy CFO (in charge of Compliance & Crisis Management Department) and Audit & Supervisory Board Members, as well as related departments such as the Legal Department, the Human Resources Department, and the Public Relations Department, and conducts the initial response, necessary investigations, etc., as is appropriate. The status of actions taken and the results will be reported to the Deputy CFO (in charge of Compliance & Crisis Management Department) and Audit & Supervisory Board Members. If an employee commits a fraudulent activity, they will be dealt with strictly through procedures according to the award and punishment rules, such as the establishment of a disciplinary committee. In addition, in order to prevent similar COCE violations from occurring within our group, the outline of the case, the root cause of occurrence, the recurrence prevention measures, etc. are shared quarterly within our group and are used for compliance education at our company and each group company.

6. Cases of Uncovered Corruption

In the fiscal year ended March 31,2024, there were no corrupt acts uncovered inside Toyota Tsusho, and thus there were no payments of fines or penalties.

Whistleblowing System

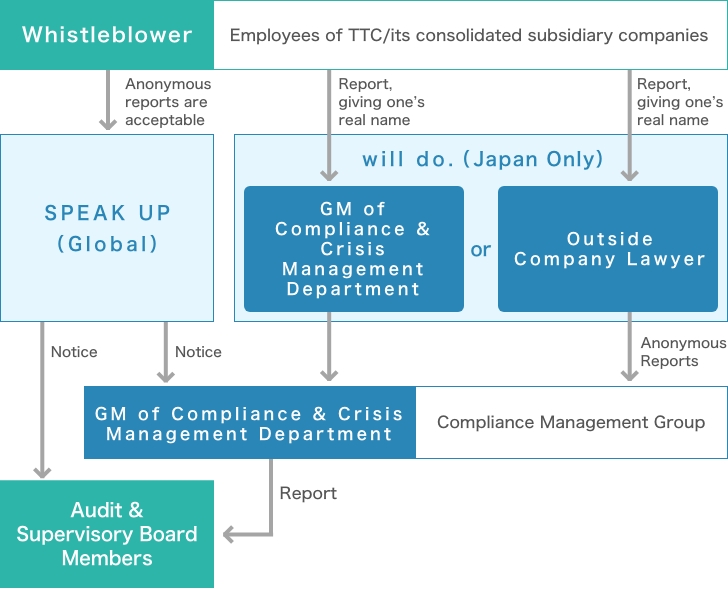

The Toyota Tsusho Group mandates that any concerns regarding COCE violations be immediately reported to a superior or the relevant department of the Administrative Unit. However, a whistleblowing system has been established for cases such as when there are impediments in reporting to a superior or department-related Administrative Unit for some reason.

The whistleblowing system was expanded and extended from its previous form, in which reporting was only possible through internal reporting lines and external lawyers, by adding a dedicated external reporting line. This reporting line, created in November 2017, offers multilingual support (currently, in more than 150 languages), and makes it easier for employees to report or consult on matters related to COCE violations, including all forms of corrupt acts and human rights violations, by providing a global service with greater anonymity and confidentiality. Notices or reports on all whistleblowing information and the status of responses are sent to Audit & Supervisory Board members, and a whistleblowing system that allows whistleblowers to notify directly to Audit & Supervisory Board members has been established to ensure independence from management.

We will continue to promote the development and operation of a more reliable and effective whistleblowing system, and strive to further strengthen compliance management and enhance corporate value.

Whistleblowing System

Origin of the Name "will do."

will: It expresses the will and determination to improve Toyota Tsusho.

The reason we use lower-case letters is to make this matter more familiar to you by leaving the space for "I", "We", and "You" in the name.

do.: It expresses the realization of the will and determination to improve the company.

Origin of the Name "SPEAK UP"

The name "SPEAK UP" represents our desire to create a lively and exciting work environment by providing an environment in which it is easy to report concerns and by ensuring that employees feel safe and comfortable in speaking up.

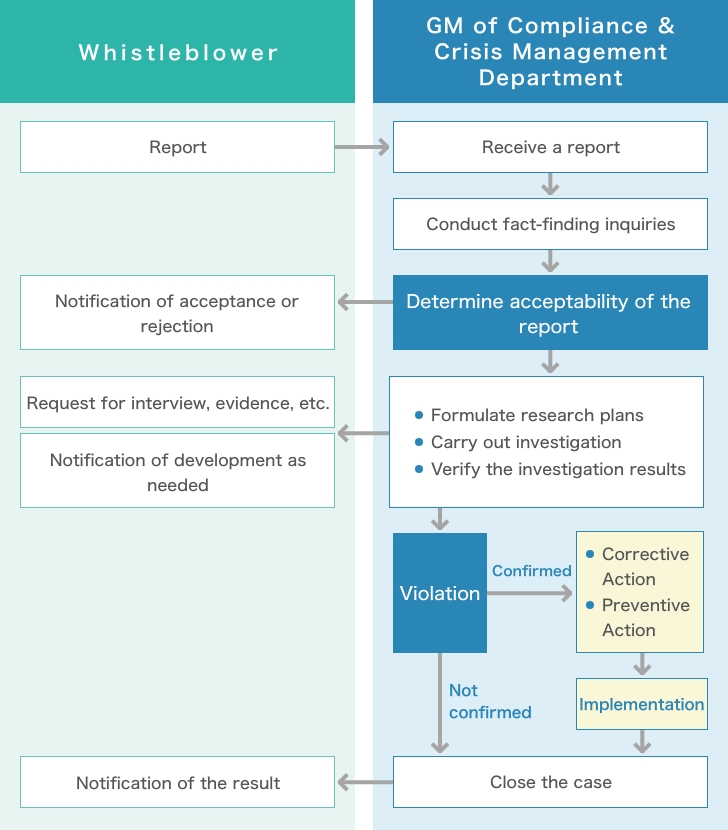

Feedback Process

In the fiscal year ended March 31, 2024, we received 161 reports through SPEAK UP and will do. 161 reports were subjected to hearings and internal investigations, etc. As a result, we confirmed 26 cases as breach of COCE.

The breakdown of the 26 cases is as follows.

60%: Discrimination and harassement (including sexual, moral, gender...)

12%: Working hours, pay

12%: Health and Safety issues

8%: Legal compliance issues

8%: Ethical issues (confidential information management, conflict of interest, insider trading, etc.)

For these issues, corrective actions and measures to prevent recurrence (e.g., improvement of systems, modification of rules, and thorough dissemination of information) were implemented.

In five of these cases, disciplinary actions were taken in accordance with company rules.

Contact Point

We have set up a contact point on our website so that the general public and stakeholders of Toyota Tsusho can make inquiries, and the appropriate department responds according to the content of the inquiry.

Activities to Raise Compliance Awareness

To ensure that specific laws and regulations that must be adhered to in daily operations are thoroughly understood by executives and employees, we conduct various training sessions and seminars, obtain pledges of COCE compliance from all executives and employees, and organize mandatory e-learning courses for all employees. Additionally, during the Business Ethics Month of October, we hold compliance events. Through these activities, we review the status of compliance with laws and regulations, striving to ensure thorough adherence to legal and corporate ethics standards.

In the fiscal year ended March 31, 2024, we held training for various levels of the organization, including new employees, newly appointed managers, line managers, and executives, as well as for specific groups such as newly appointed executives at domestic Toyota Tsusho Group companies and employees about to be stationed overseas. The company also conducts training, e-learning, and information sessions for executives and employees on topics such as insider trading, bribery prevention, cartels, supply chain CSR, and the COCE to ensure that all personnel are fully aware of the prohibition of corruption in all forms. In addition, the company reviews, revises, and issues the Laws & Ordinances Handbook for Executives for executives and a compliance manual for employees every two years so that the entire company workforce is familiar with important laws to ensure strict compliance with laws, regulations, and corporate ethics.

Performance Evaluation

At our company, at the beginning of the term, all employees set competency goals, including ethics and beliefs (always maintaining a high sense of ethics and adhering to right actions). They strive to act in accordance with these goals. After undergoing a mid-term review with their supervisors, at the end of the term, the supervisors evaluate and score their achievements, which are then reflected in the final personnel evaluation. Additionally, the final personal evaluation is reflected in the employees' bonus amounts for the respective fiscal year.

Third-Party Audit

The content and implementation status of the aforementioned COCE compliance activities and various compliance measures based on COCE are subject to audits every year by external independent auditors, including supporting and related documents, as part of the internal control audit under the Financial Instruments and Exchange Act.

Tax Governance

Tax Governance Policy

The basic policy of Toyota Tsusho and the Toyota Tsusho Group is to comply with the tax laws and regulations of individual countries, under the responsibility of the CFO and following the COCE, and to appropriately satisfy global tax obligations.

We attach great importance to conducting all our business activities properly and rationally. We will expand our business and build a global structure in line with our business objectives, and we will not intentionally avoid taxes using tax havens. We strive to comply with the laws, regulations, and tax conventions of individual countries, as well as with international taxation rules, appropriately reporting income and paying taxes. We build fair relationships with tax authorities in the regions in which we do business by appropriately disclosing information and engaging in constructive dialogue.

Under our basic policy, we strive to eliminate double taxation and appropriately utilize tax incentives to achieve appropriate tax costs.

Tax Governance Structure

The Representative Director CFO, issues and directs basic policies regarding tax costs and supervises the proper allocation of tax expenses and the fulfillment of tax obligations under the following structure.

- Officer in charge: Hideyuki Iwamoto (Representative Director CFO)

- Department: Accounting Department

The General Manager of the Accounting Department and the Accounting Department work together with the Business Accounting Department and the relevant accounting departments of domestic and overseas subsidiaries to manage tax obligations on a global basis. In addition to reporting tax-related risks and events from domestic and overseas subsidiaries to the Accounting Department, tax risks are reviewed when examining individual projects. Furthermore, when the General Manager of the Accounting Department recognizes significant tax-related events and risks, appropriate reports are made to the Representative Director CFO.

The CFO reports on important tax-related matters at meetings of the Board of Directors or Executive Officers, as necessary, in an effort to improve the tax governance system.