CFO Message

Fourth Consecutive Fiscal Year of Record-high Earnings Thanks to Successful Portfolio Management and Lean Operations

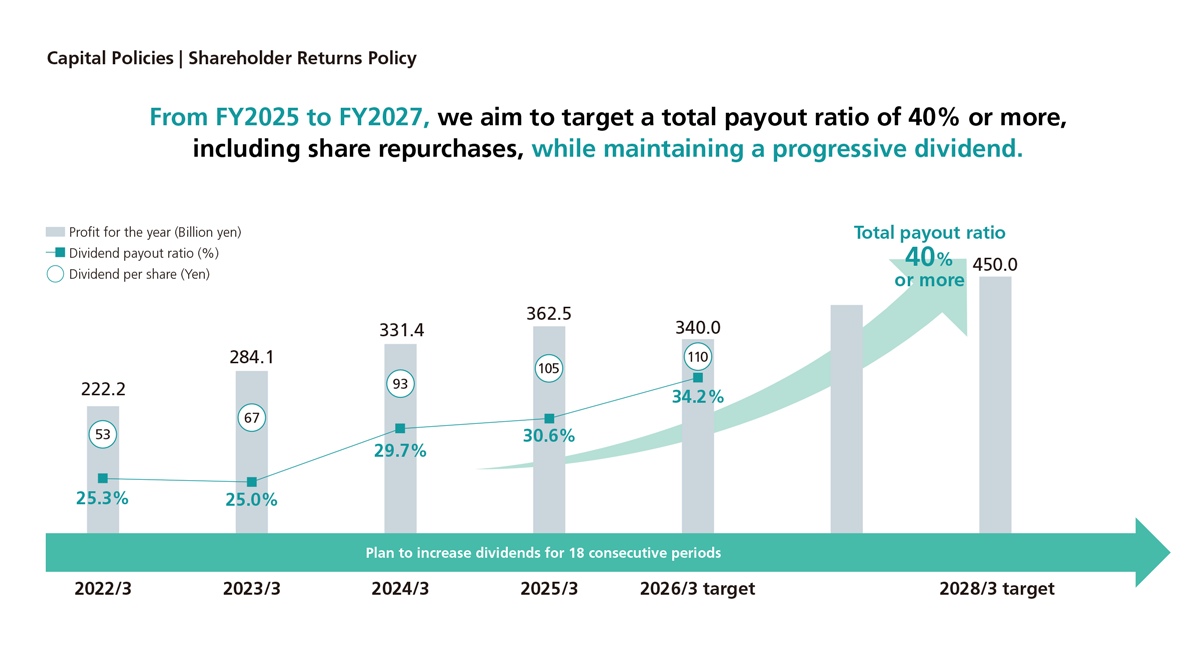

For the fiscal year ended March 31, 2025, we achieved 362.5 billion yen in profit for the year attributable to owners of the parent (profit for the year), giving us our fourth consecutive fiscal year of record-high earnings and growth of 9% from the previous fiscal year. It was a genuinely satisfying result that exceeded our high targets. It was also a year that gave us great momentum for the future.

Two factors behind this positive result were that we did not accrue any major losses during the year and that we achieved an effective integration of our product and regional portfolios. In terms of products, we are seeing the aggregation of the already-large automotive industry into an even more massive presence that incorporates elements of a range of other industries, including electronics, semiconductors, and batteries. In terms of regions, we have tremendous strengths in our Africa business, which has performed exceptionally, with profits almost quadrupling over the last few years. For the fiscal year ended March 31, 2025, our Africa Division recorded an annual profit of 79.5 billion yen. This was all thanks to a strategic redirection of assets to Africa from an early stage, and a review of our regional portfolio that we took on our own initiative.

Financially, we focused on managing our balance sheet and succeeded in our pursuit of waste-free operations. As a major outcome, we have been able to generate an operating cash flow of around 500.0 billion yen for three consecutive years.

Expanding the Scope of Three Value Domains to Achieve Profit of 450.0 Billion Yen for the Fiscal Year Ending March 31, 2028

At the end of April 2025, we announced our new Mid-Term Business Plan for the fiscal years ending March 31, 2026, through March 31, 2028.

For the first year of this plan, the fiscal year ending March 31, 2026, we expect a leveling-off of economic growth due to a shift from free trade to protectionism in the global economy. We were therefore careful to establish a more conservative plan. We incorporated the impact of U.S. tariffs, which are of concern, as a negative factor in profit for the year, with an impact of around 5.0 billion yen. In terms of exchange rates, we also assumed that the yen would remain high compared to the previous fiscal year, as a result of which we estimated profit for the year of 340.0 billion yen.

While facing such external factors in the short term, the medium-term outlook for our businesses is bright. For this new Mid-Term Business Plan, we set a target of 450.0 billion yen in profit for the fiscal year ending March 31, 2028. We are therefore aiming for more aggressive growth by setting a higher target than for the previous Mid-Term Business Plan.

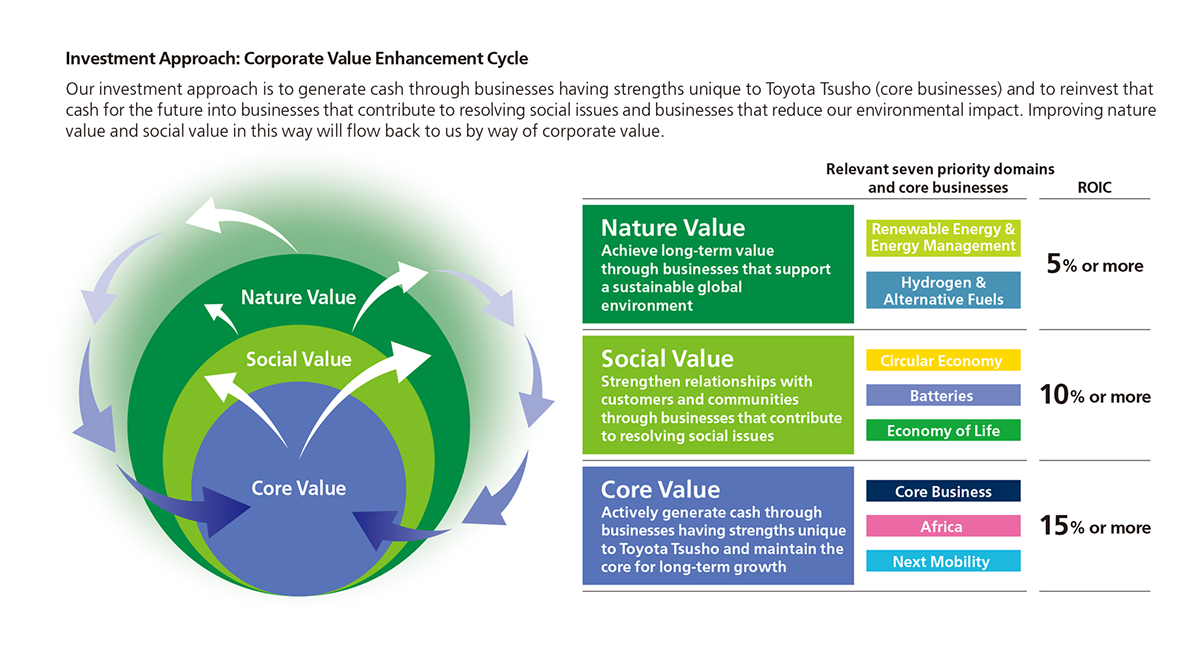

In the previous Mid-Term Business Plan, we organized our domains for investment under three values. The first of these is core value, which is where our strengths lie, including our mobility and semiconductor-related businesses. The second is social value (value generated by businesses that contribute to solving social issues), where we use the social capital of our battery, recycling, and other businesses and return the added value generated to social capital. And the third is nature value (value generated by businesses that reduce impact on the environment), where we return value to natural capital, including our renewable energy and hydrogen-related businesses.

Our target of 450.0 billion yen in profit for the year is based on expectations that growth in our core value businesses will continue and that we will reap the benefits of years of investments. As we target even greater growth, we will continue our strategy of investing in more distinctive markets. During the fiscal year ending March 31, 2026, we will focus in particular on circular economy businesses, centered on recycling, as part of our social value efforts, which have already included our acquisition of Radius Recycling, Inc. in the United States, announced in July 2025.

In line with the Toyota Group's expansion of its plants, we have been engaged in resources recycling businesses in Japan and overseas since the 1970s. Leveraging this experience, we aim to develop an automobile collection and recycling platform, including battery recycling, in the huge U.S. market, with Radius Recycling at its core. After building a track record in the U.S., we will then move to India, China, and other markets.

We will strive to expand our core value mobility-related businesses with a view to the future while carefully identifying market trends. Taking into account that the shift to battery electric vehicles is slower than expected and that it will take time to achieve returns in renewable energy due to the nature of the business, we are placing our expectations on the recycling business in this new Mid-Term Business Plan.

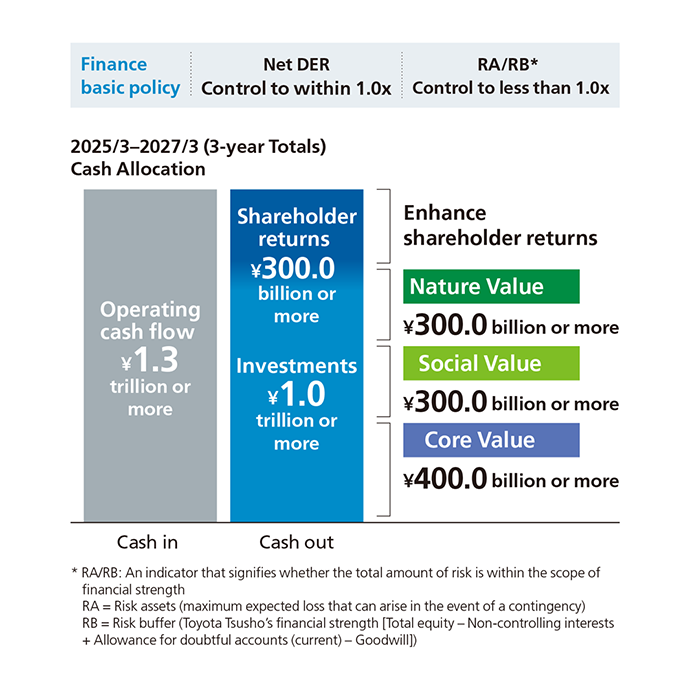

Investing 1.2 Trillion Yen over 3 Years

Since announcing our ROIC targets in the previous Mid-Term Business Plan, awareness of ROIC management has spread within the company.

In this new Mid-Term Business Plan, we have set ROIC targets for each of our designated values, with targets of 15% or more for core value, 10% or more for social value, and 5% or more for nature value. Clarifying ROIC targets by value domain this way will enable us to appropriately allocate our investments.

Breaking down our investments by type of value, we expect to allocate 500.0 billion yen to core value. This investment is for such things as further expanding our existing businesses, adding functionality, and improving efficiency through digital transformation. We will also allocate 400.0 billion yen to social value. This investment is for proactive efforts to secure an advantage in target markets, including the recycling business I already mentioned and the healthcare business in India. And finally, we will allocate 300.0 billion yen to nature value for careful, staged investments, with consideration given to the investment environment and timelines of the renewable energy business.

Please note, though, that these allocations are based on current expectations, and they prioritize returns. We plan to be flexible in our search for businesses to invest in while constantly assessing the business environment. For example, there are currently projects in the social and nature value domains that are falling short of expected profit levels, but we have expectations for upsides over the coming three years in terms of technological and business model transformations. When it comes to social value, we are making preemptive moves based on the potential for increased awareness of the added value that recycling can bring to help limit new mining of underground resources. Equally, regarding nature value, we are expecting a growth in returns in the area of renewable energy due to technological innovations in power storage and conditioning.

Looking at this 1.2 trillion yen investment in terms of regions, we aim to invest 400.0 billion yen in the Global South. Having achieved a dominant position in Africa, we now intend to focus on India, Indonesia, and other countries as our next markets. We will apply the backcasting method, while studying our achievements in Africa, to identify optimal businesses for each region.

For example, India is not a market in which a growing middle-income group contributes directly to economic growth, as it does in Africa. Rather, it is a complex market with independent states having a mix of ethnicities and cultures. However, our strong relationships with Japanese automakers are delivering solid profits. In the mobility area, we intend to grow our business in India by combining our current business foundation with insights we acquired through our Africa business. Therefore, there will be no need for additional large investments in areas such as asset acquisition. And speaking of asset acquisition businesses, we plan to focus on the fields of healthcare and lifestyle, including hospitals.

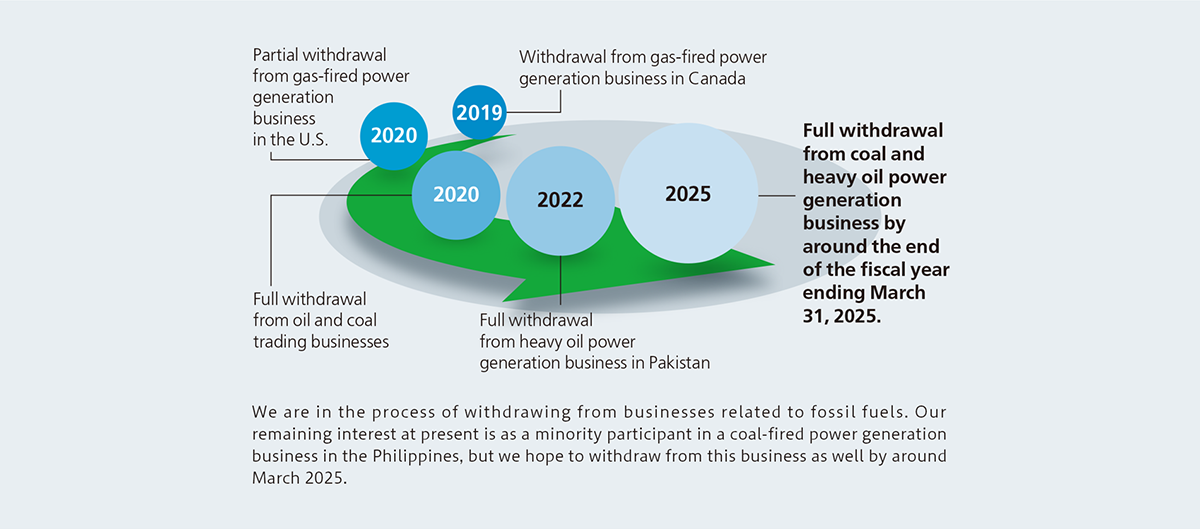

On the other hand, we will continue to identify and replace businesses that do not have potential for profit growth. We still have numerous businesses within our corporate group achieving net profit after tax of 100.0 million yen or less, so we will take new steps to rectify this situation. We have completed our withdrawal from petrochemical businesses, we have no stranded assets, and we only have a few equity-method investments. We will return to the basic premise of businesses being profit-generation vehicles, and we will identify which of our businesses to spend time developing, which to consolidate, and which to discontinue.

Striving to Maintain ROE of 15% by Pursuing Returns and Reducing Shareholders' Equity

We established a company-wide target of 15% ROE for the fiscal year ending March 31, 2028. In addition to pursuing returns, we are also considering reducing shareholders' equity to achieve this target.

In terms of pursuing returns, we will actively invest at an even higher rate than before. We set ourselves a three-year cumulative operating cash flow target, on which our investment strategy is based, of 1.4 trillion yen. The nature of our businesses is that sales directly impact cash, and because we only have limited investment profits accounted for using the equity method, we can book net profit after tax as cash. We also constantly generate almost 500.0 billion yen in cash annually, including through depreciation expenses, and have even exceeded 500.0 billion yen in cash flows for the two most recent consecutive years. Therefore, our target of 1.4 trillion yen over three years is conservative.

On the other hand, net debt-to-equity ratio (DER) for the fiscal year ended March 31, 2025, fell to 0.39 times. Even with a plentiful operating cash flow, we are aware of the need to further leverage our position as a trading company. To this end, we clarified our policy in this new Mid-Term Business Plan to use both operating cash flow and financial cash flow as investment resources. We lowered the management criterion for our net DER indicator from the up to 1.0 times in our previous Mid-Term Business Plan to a more realistic up to 0.8 times. We also promoted internally a policy of further leveraging ourselves to invest more often and in large projects as well. To boost profitability, we are taking a more aggressive stance in our search for new business opportunities while adding multiple projects to the pipeline.

In terms of reducing shareholders' equity, we decided that now is the time to take serious measures. We will, therefore, focus on capital policy and work to create a leaner balance sheet by eliminating cross-shareholdings.

For the fiscal year ending March 31, 2026, we intend to reorganize our cross-shareholdings within the Toyota Group. By value, our holdings in Toyota Industries Corporation account for about 80% of such stocks. By divesting these stocks, we will further improve our balance sheet bottom line. We understand the importance of properly implementing capital policy within the Toyota Group. At the same time, however, it is also extremely important that we fulfill our investor relations accountability in terms of capital policy. Thus, our challenge is to clearly explain that policy to our long-term shareholders.

Of course, we still have to think about progressive dividends to meet the expectations of shareholders. From this new Mid-Term Business Plan, we have set a new target of 40% or more for the total payout ratio. To maintain the previous policy of continuous progressive dividends, we are also considering the acquisition of treasury stocks as one measure of returns to shareholders.

A Promise to Create New Value Through Unique Businesses and Solid Growth that Meets Expectations

We realize that to meet the expectations of shareholders, it is important that the stock market appreciates our growth potential. We are also aware of issues with our current price-to-equity ratio (PER), which is an indicator of corporate growth.

When it comes to business activities, our shareholders positively evaluate us for the good results produced by our unique businesses pursued by no other company. They also rate us highly for the size of the automotive industry and our solid relationship with industry leader Toyota Motor Corporation. To ensure even more stakeholders feel the same way about us, we will strive to enhance corporate value on many fronts.

As one of those efforts, we implemented a stock split in July 2024. We are not only working to expand the investor base through this action but also to increase the liquidity of our stock as well.

To continue improving ROE as in the past, we will implement an investment strategy that attracts and excites the stock market, with a rollout over the coming three years of businesses that other companies do not have.

During this new Mid-Term Business Plan, we are implementing an investment strategy focused on the keyword "synergies." By generating synergies among our various strengths, business domains, and local markets, we aim to provide new value and achieve sustainable growth. From our distinctive Africa businesses to recycling, renewable energy, batteries, and other businesses, by skillfully combining many different elements, we will create a new and unique business model that achieves corporate growth. In addition to this unique business development, we will put even more effort into related public relations activities. In this way, we expect a positive reaction to our growth pathway that will lead to an improved PER.

As shown by our past results, we have made good on our promises to improve business performance and dividend payouts. We ask our shareholders and investors to have faith in us, look forward to a positive long-term future, and continue to offer their support.