Medium Term Management Plan

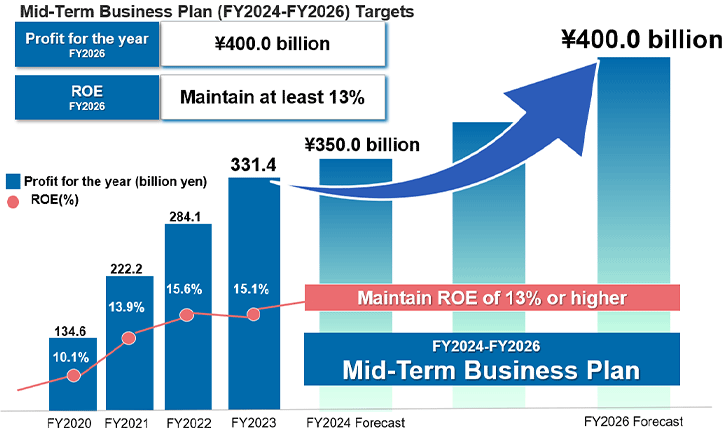

Quantitative targets

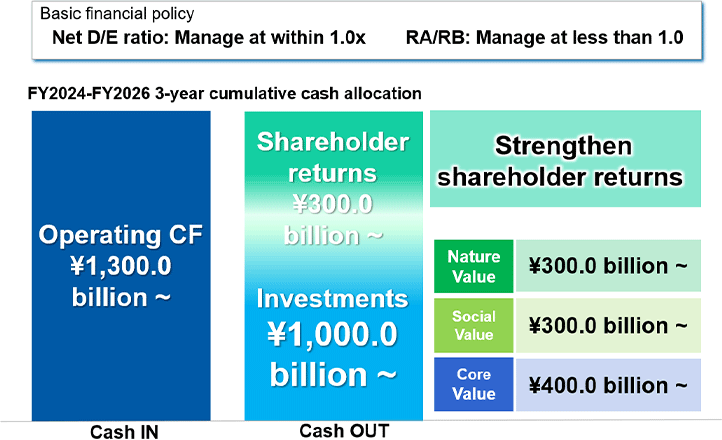

Growth investment | Investment allocation

Capital policies | Capital allocation

Capital policies | Shareholder Returns Policy

Briefing materials is available here.

- *We revised the consolidated earnings and dividend forecast. For more details, please refer to “Notice concerning Revision of Consolidated Earnings Forecast, Interim Dividend, and Revision of Year-end Dividend for the Fiscal Year Ending March 31, 2026” released on October 31, 2025.