Risk Management

Risk Management System

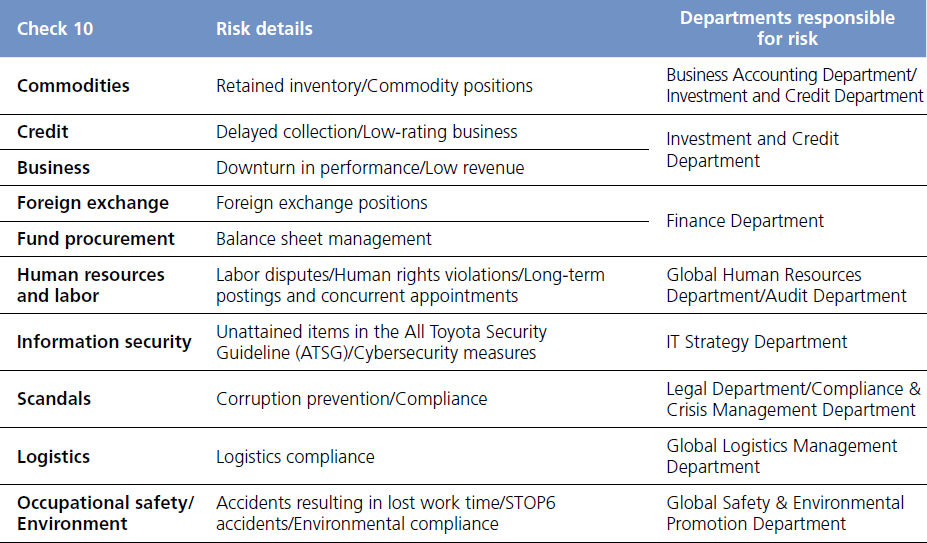

We define "risk" as "an event with the potential to cause unexpected losses in business operations, or cause damage to the Toyota Tsusho Group's assets and trust, etc." as laid out in the company's Risk Management Basic Policy. The company's fundamental approach is to identify and consider the various risks that occur in the course of business operations, ensure management safety, and increase corporate value by exposing itself to risk only within an appropriate and controlled range. In concretely implementing the Risk Management Basic Policy, besides risk management by the respective departments responsible for risks carried out individually in the past, the former Enterprise Risk Management Committee was evolved in April 2020 into the Integrated Risk Management Committee, which verifies the state of risk management on a more global basis, referring to the COSO*-ERM Framework and other concepts. The committee, chaired by the CFO, is mainly joined by the head of risk management in each overseas region, as well as the general managers of the planning department of each sales division and the directors and general managers in charge of each risk. The committee applies our "Check 10" consolidated risk management system.

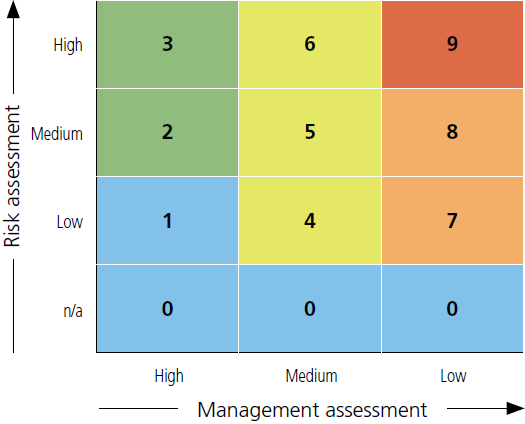

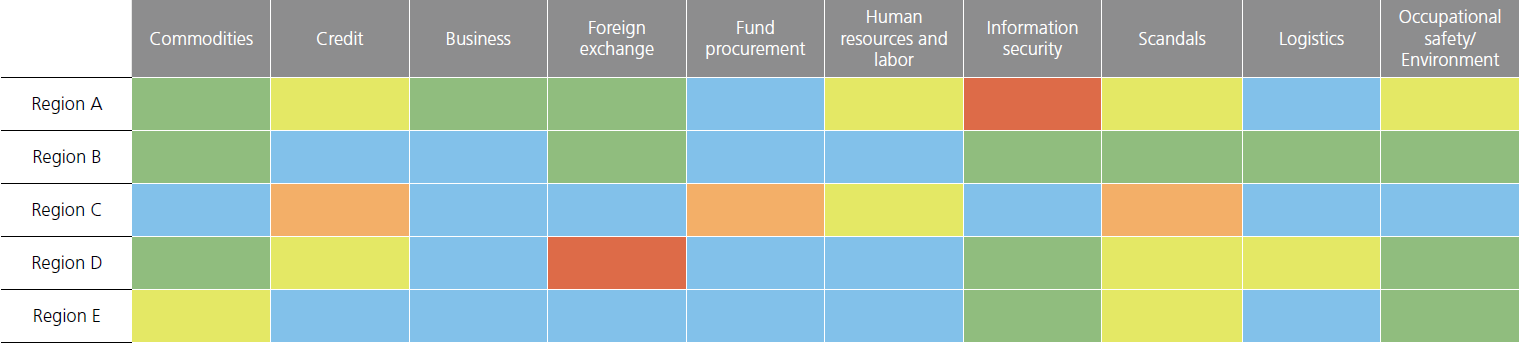

Check 10 activities are defined as the 10 risk items (product, credit, business, foreign exchange and funding, internal controls, human resources and labor, information security, misconduct, logistics, and occupational safety and environment) that should be given the highest priorities among the risk items. Each business entity evaluates and scores on the two axes of risk and a management system, prepares a heat map, and realizes visualization of both quantitative and qualitative risks. The relevant risk assessment is then analyzed and supported by the Risk Supervisory Department. To identify global risks and problems, and then work to eliminate and minimize them, we discuss and promote the necessary countermeasures to establish and strengthen the risk management system on a consolidated basis for the risk of our group companies.

The committee also clarifies risks through the meetings that could give significant impacts on the Toyota Tsusho Group’s management, identifies important company-wide risks related to management objectives, discusses and decides on response policies, verifies the effectiveness of the risk management process, and reports to the CEO. The committee makes recommendations to the Board of Directors meeting regarding risk management. Based on the recommendations, the Board of Directors meeting continuously supervises the effectiveness of the risk management process and takes appropriate actions when changes are necessary.

* Committee of Sponsoring Organizations of the Treadway Commission

Risk Management

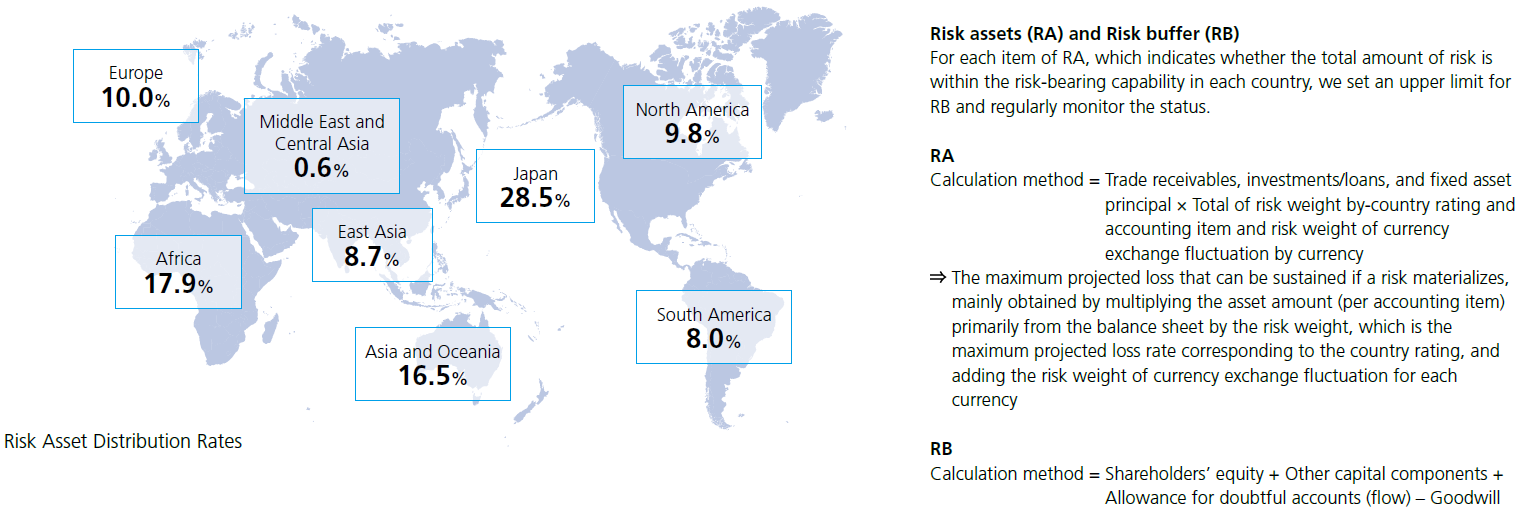

Risk Assets (RA) and Risk Buffer (RB)

To verify that the total amount of financial risks is within the scope of our management capabilities, the company regularly measures its risk assets (RA)—the maximum expected loss on a consolidated basis—and endeavors to ensure that risk assets are balanced by the risk buffer (RB), which is the company's financial corporate strength. RA are calculated by multiplying the risk asset principle based on each account on the balance sheet by the risk weight (RW) indicated by the maximum expected loss ratio, while the RB is defined and calculated as the corporate group's total financial corporate strength. We are striving to maintain a sound and stable financial position by continuing to increase the RB based on profit for the year attributable to owners of the parent.

The risk management of RA is carried out by maintaining the ratio of RA to RB below 1.0. Our policy is to maximize operating cash flow by promoting cash flow management down to the business unit level and increasing business profitability and working capital efficiency, and then use the cash created to maintain a balance between investment in growth and shareholder returns. As a result of these continued initiatives, in the fiscal year ended March 31, 2023, we again maintained RA within the scope of the RB. (The ratio of RA to RB was 0.7, which is below 1.0.)

Also, we conduct country risk management to prevent an excessive accumulation of risk by evaluating the total amount of RA and keeping this total beneath the upper limit determined for each country. We also introduced Risk-adjusted Value Added (RVA) as a measure of risk profitability to secure returns commensurate with risks.

Major Risks

Product Risk

Toyota Tsusho sets position limits for market product transactions that are exposed to the risk of commodity price fluctuations, such as non-ferrous metals, petroleum products, rubber, foodstuffs, and textiles, regularly monitors whether these limits are being applied, and takes measures to mitigate price fluctuation risks.

Credit Risk

Toyota Tsusho rates business partners on eight levels based on their financial position using independent criteria and specifies limits for each type of transaction, such as accounts receivable or advance payments. For business partners who receive low ratings, our company establishes loss-prevention transaction policies such as reviewing transaction conditions, protecting accounts receivable or withdrawing, and conducting individually focused management.

Business Investment Risk

We aim to expand existing businesses, strengthen functions, and enter new businesses by strengthening existing partnerships and forming new alliances. We discuss the strategic nature and company-wide priorities for new investments. Both the sales department in charge as well as those in charge of the Administrative Unit participate in the review process, examining investment returns and various risk analyses from a wide range of perspectives. In addition, after investments are made, we monitor whether investment returns are achieved as planned and whether profits commensurate with risk assets are secured, and strictly apply restructuring and withdrawal rules for projects that are not progressing as planned.

Foreign Exchange Risk

Toyota Tsusho implements hedge measures, including using forward exchange contracts, for transactions denominated in foreign currencies, as they are exposed to the risk of fluctuations in foreign exchange rates. In the event we are unable to hedge a transaction, we implement measures that mitigate foreign exchange rate fluctuation risks by setting position limits and regularly monitoring the results of these transactions.

Risks Related to the Fund Procurement

We strive to minimize liquidity risk by maintaining sound business relationships with financial institutions, engaging in asset liability management (ALM), and procuring funds in accordance with the nature of our assets.

Human rights risks

We began conducting human rights due diligence at all consolidated subsidiaries in the fiscal year ended March 31, 2022 in order to respond to human rights risks that could have an impact on society through business activities.

Based on the opinions of internal and external experts, we analyzed human rights risks at all consolidated subsidiaries around the world from three perspectives: business natures (business sector), location (country), and products handled. We identified 93 companies where confirmation of priority risks is thoroughly needed. The four salient human rights issues that we investigated during this due diligence process were forced labor, child labor, discrimination, and the freedom of association and right to collective negotiations.

We surveyed the 93 subject companies using a questionnaire to understand the management status of anticipated specific human rights risks. Based on the results of the questionnaire, we identified companies that we believed required further investigation. We then investigated the actual situation through an interview with the presence of third-party organizations and established the direction of specific measures to reduce risks.

No human rights issues of immediate concern were identified through this process, but we will continue our efforts to reduce human rights risks.

The status of this process and the evaluation results are reported to the Sustainability Management Committee.

Information Security Risk

Based on our Information Security Policy, we implement risk management through the following measures.

- 1Deployment of security guidelines

- Toyota Tsusho group standard Information security management guidelines (All Toyota Security Guideline) have been established and deployed globally, and compliance with these guidelines is continuously monitored and improved.

- We review this guideline regularly to deal with ever-increasing risks of cyber attacks, etc. and at the same time, make efforts to improve the management capability of each group company.

- 2Deployment of group standard security management systems

- We have established group standard security systems and are deploying and managing them globally in order to promote adherence to the guidelines efficiently and uniformly.

- As the group standard security systems, we have standardized Major IT functions such as network security, email security, and PC security globally and we will expand them as appropriate in the future.

- 3Building a response system for cyber attacks

- We have established a Computer Security Incident Response Team (CSIRT) and the CSIRT are implementing preventive activities to reduce the risk of security incident by continuous collecting / analyzing threat information and monitoring activities using the group standard security systems.

- In order to minimize damage in the event of a security incident, we have established a collaboration and support system with group companies, and are working to create an environment where we can identify the scope of impact, take measures, and prevent recurrence immediately.

Compliance Risks

We established the Compliance & Crisis Management Department to strengthen the compliance system of the entire Group. In doing so, we aim to raise awareness of compliance, including thorough compliance with laws and regulations.

Occupational Safety & Health Risk and Environmental Risk

We establish management rules or guidelines concerning occupational safety & health and environmental risk and appropriately identify and manage these risks.

Environmental Risk Management

The Group's business entities are operated in accordance with environmental policies and biodiversity guidelines. For existing business units, we are working to reduce the risk of environmental pollution by quantitatively evaluating the degree of environmental pollution risk for each facility and the management level of work sites. In addition, we carry out a compliance evaluation for environmental laws and regulations every six months, and double-check the status of legal compliance of priority issues through internal and external audits.

Country Risks

We strive to reduce risks for projects in countries with high country risk through export and investment insurance and other means. We also aim to reduce the concentration of risk in specific regions or countries by monitoring risk-weighted assets, which is the maximum expected loss, for each country and keeping it within an upper limit set for each country.

Crisis Management

Overseas Crisis Management

In response to a major terrorist attack in Algeria in January 2013, the Security Management Group was established as a specialist organization within the Global Human Resources Department in April of that year. Currently, the Crisis Management & BCM Group of the Compliance & Crisis Management Department conducts education and training includes pre-assignment seminars for employees (and their families) stationed overseas and hands-on training that enables them, in a controlled environment, to learn about and to experience the risks unique to their country or region.

- 1A seminar on basic precautions while on business trips abroad is held for young employees with little overseas experience.

- 2Hostile Environment Training, which includes topics such as terrorism, is conducted for personnel assigned to high-risk countries. We have stepped up our monitoring and analysis of security information and have developed a website through which we share information with Toyota Tsusho Group employees all around the world. We have also established a 24/7 response system offering medical consultation with a physician by telephone and emergency medical transport for employees stationed overseas.

Business Continuity

The Toyota Tsusho Group has established a Business Continuity Management (BCM) system led by the Crisis Management & BCM Group of the Compliance & Crisis Management Department.

Toyota Tsusho's Business Continuity Plan (BCP) is an all-hazard BCP that takes into account all risks, including natural disasters such as earthquakes and typhoons, terrorist acts, pandemics, and cyber-attacks, and has been formulated for 210 businesses in Japan and overseas. Specifically, in accordance with the Toyota Tsusho Group Basic Business Continuity Principles, we have prepared plans to prevent business interruption or, to restore operations as quickly as possible even in the event of interruption, assuming scenarios in which key management resources are unavailable, such as employees not being able to come to work, not being able to enter the headquarters, long-term power outages, or not being able to use IT systems. Based on the formulated response plan, we conduct initial disaster response drills in September and March of each year, based on the scenario of a large-scale earthquake. We also conduct educational and awareness-raising activities for our employees worldwide by publishing a collection of case studies of businesses that have formulated BCPs and regularly issuing newsletters in both Japanese and English. Based on the BCP formulated to maintain an appropriate management system, we conduct periodic exercises and improvements, and continue to operate through the PDCA cycle.

TTC Group Business Continuity Principles

- 1The Safety of employees and their families is the first priority.

- 2Even if unexpected contingencies occur, we will not forget the Corporate Philosophy: Living and prospering together in society. All employees will fulfill their social responsibilities.

- 3We take preventive measures against predictable risks. We maximize Team Power to recover quickly from unexpected contingencies. We minimize impact to customers and continue our business.

- 4We promote the understanding of our Business Continuity Principles to all employees by means of education and training. We consistently perform KAIZEN (continuous improvement) to tackle Business Continuity Management (BCM), which should be based on Real Places, Real Things, and Reality.

Conflict Mineral

There are worldwide concerns that mineral resources mined in the Democratic Republic of the Congo (DRC) and nine neighboring countries are the source of funding for armed groups that are causing human rights abuses and environmental destruction. A survey has been conducted every year since 2013 to check whether these conflict minerals are contained by going back to the supply chain globally, centered on US-listed companies, and we are also actively participating in the survey as a member of the supply chain.

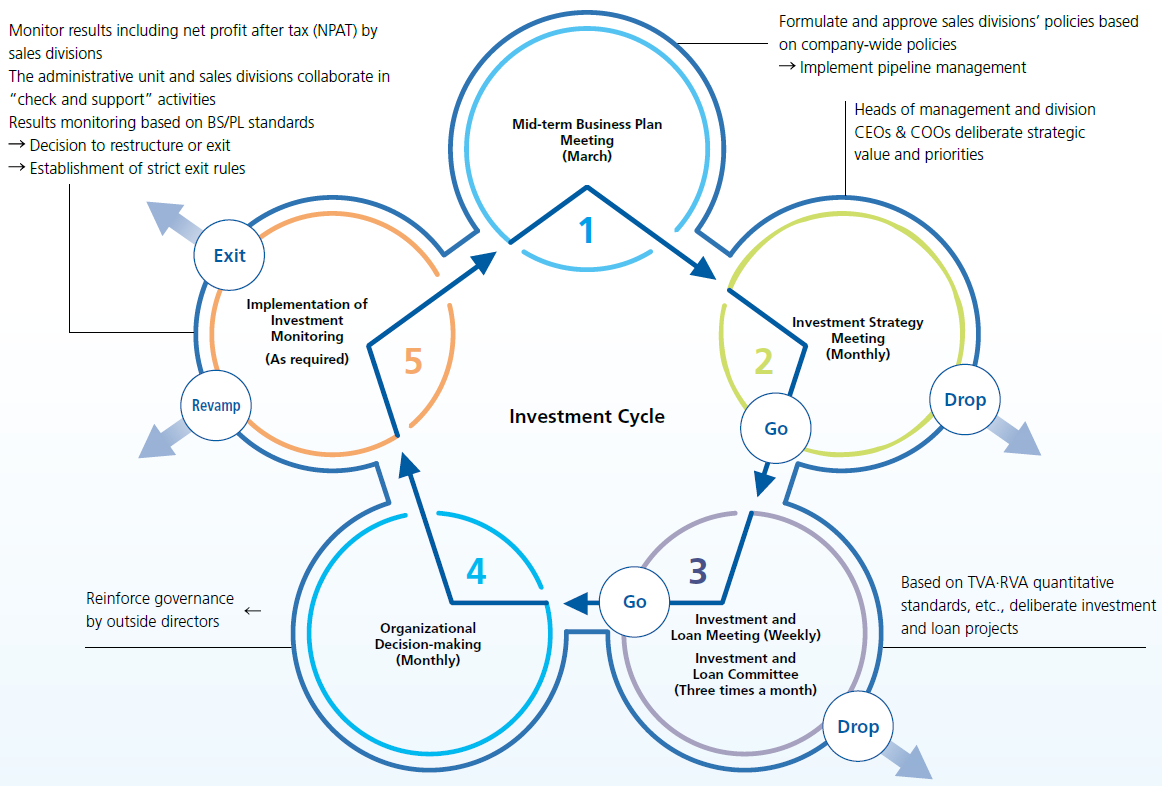

Investment Cycle Management

To achieve sustainable growth, Toyota Tsusho believes it is important to appropriately manage risk and generate reliable results from investments. Rather than investments aimed at short-term profits, based on strategic investment whereby a business is developed over the medium to long term leading to expansion and strengthening of the Toyota Tsusho Group's value chain, we have developed a system that optimizes the knowledge and experience accrued throughout the company to engage in deliberations at each stage of investment, from initial investigation to implementation. We have also enriched our systems for investment follow-up to solve problems faced by our business companies and replace assets.

We closely examine all aspects of balance sheet, and we have inspection processes on geopolitical and country risks from a wide point of view, as well as continuous analytic processes on the risks of fluctuations in foreign exchange rates, interest, commodity price, and credit risk, etc. These are also applied to the screening process for new investment, all of which are inspected thoroughly prior to the Investment and Loan Committee and the Investment Loan Meeting.

Regarding new investment projects, major policy is decided at the Mid-term Business Plan Meeting and the Investment Strategy Meeting, while decisions on individual projects are made by the organization concerned based upon business plans screened by the Investment and Loan Meeting and the Investment and Loan Committee. At the Investment and Loan Meeting, chaired by the Assistant to CFO, and the Investment and Loan Committee, chaired by the CFO, we use TVA,*1 which is our original indicator for verifying that the expected revenue scale is achieved corresponding to the invested capital, and RVA,*2 which is an indicator used to verify that obtained revenue is appropriate for the risk, to carry out entry management. At the same time, we conduct assessments of climate change and other environmental risks, greenhouse gas emissions and reduction effects, and other aspects using our original environmental check sheets, to quantitatively verify projects from various perspectives. Some of our affiliated companies, both in Japan and overseas, have been authorized to make investment decisions to accelerate the investment decision-making process.

After investments are implemented, the Administrative Unit and the sales divisions concerned jointly and continuously monitor and support projects facing issues ("check and support"). In addition to monitoring by the sales divisions, the Administrative Unit also monitors through balance sheets and profit/loss (BS/PL)*3 standards. If a project falls short of quantitative standards, we assess the sustainability of the business and decide whether to restructure or exit.

By continuing to repeat this investment cycle, we aim to allocate management resources optimally and improve capital efficiency.

- *1An abbreviation of Toyotsu Value Achievement,

TVA = (Ordinary income – Interest income or expenses) × (1 – Respective country's tax rate) – Invested capital × Cost rate of invested capital by country Ordinary income is profit before income taxes, adjusted for non-recurring, extraordinary, and significant gains and losses arising from non-operating activities, which indicates the "earning power" of a sales division or business entity

The cost rate of invested capital by country, is the cost rate derived from the weighted average of the cost of capital and government bond yields by country, resulting from the invested capital used in operating and business activities - *2An abbreviation of Risk-adjusted Value Added,

RVA = (Ordinary income × 60%) – Risk asset × Risk cost rate, where risk asset is the maximum amount of expected loss should a contingency (a once-in-a-century event) occur, and risk cost rate is the shareholder expected rate of return based on Toyota Tsusho's return on equity (ROE) target of 13% or more - *3BS standard: If the capital impairment ratio is 50% or higher

PL standard: If there is a net loss for two consecutive periods, or if a downturn is at least 30% of the planned value at the time of investment